The U.S. single-family rental market is showing signs of both stabilization and renewed volatility, depending on the metro. In this analysis, we examine rent trends for 3-bedroom SFRs across 10 major metros. Based on verified data from over 16 million listings collected between January 2020 and April 2025.

Table of Contents

Methodology

This report analyzes trends in the U.S. single-family rental (SFR) market, focusing on three-bedroom homes across 10 major metro areas. Based on over 16 million verified listings, all data was vetted for accuracy and filtered using a Gaussian method to reduce outliers. We tracked month-over-month and year-over-year changes to reveal both seasonal and long-term shifts. Insights are based on observed listing data, not surveys or projections, offering a real-time view of SFR market behavior. Chart axes were scaled by subtracting ~500 from the minimum value and adding ~500 to the maximum. See full methodology here.

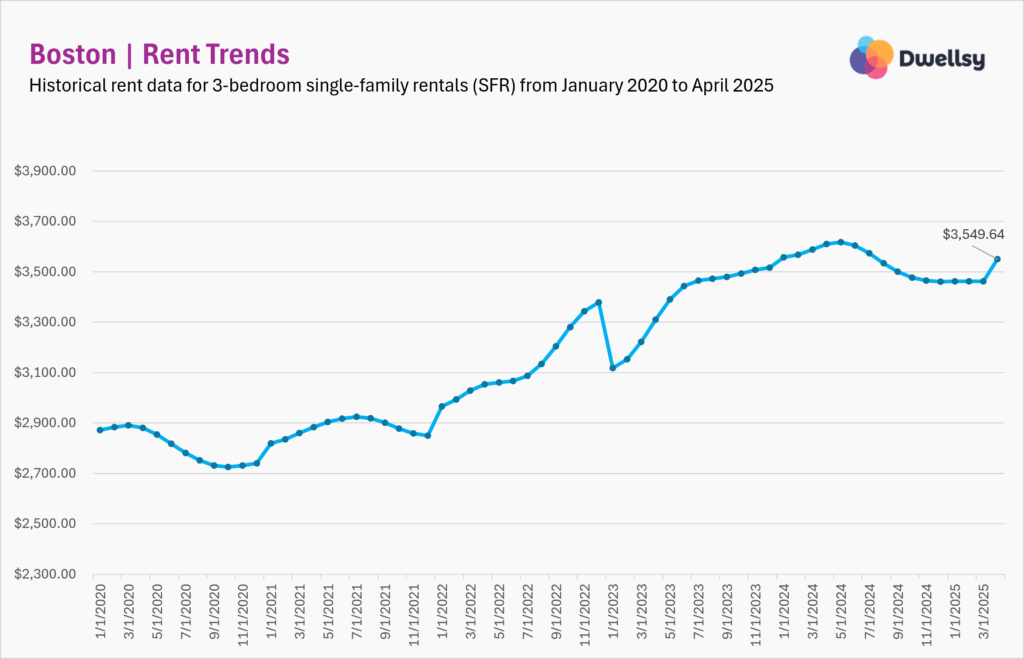

Boston

From January 2020 to April 2025, Boston’s single-family rents rose 24%, driven by a sharp 14.1% YoY jump into 2024. After peaking at $3,617 in May 2024, rents dropped $156 by year’s end — a sign of affordability strain. The market stagnated in Q1 2025, but April’s $87 (+2.5%) rebound might suggest renewed demand or a pricing reset. With a -2.7% YoY decline heading into 2025, the market appears to be mid-recalibration.

Q1 2025 was stagnant compared to the steady gains seen in Q1 2024, making April 2025’s spike (+2.5%) stand out even more next to the modest +0.6% increase in April 2024. This April jump might reflect a compressed leasing season, where delayed activity from earlier months surged all at once, or it could be a sign of the market catching up after months of hesitation.

Boston’s market continues to show inconsistent momentum, with rent trends that might be influenced by price ceilings and market saturation.

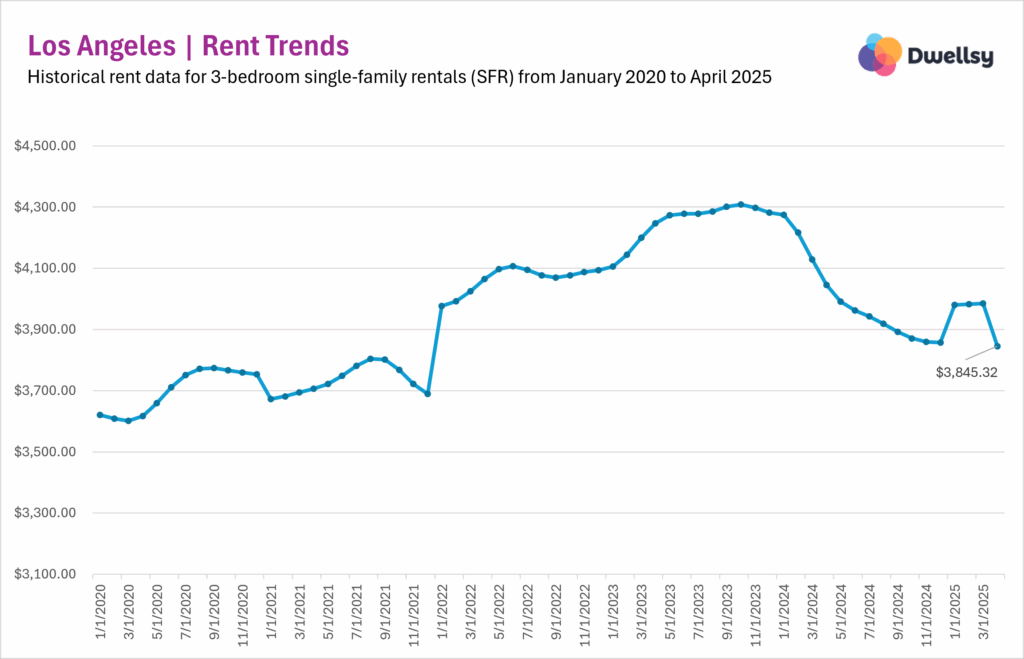

Los Angeles

Between January 2020 and April 2025, Los Angeles’ single-family rents rose just 6.2%, following a post-COVID rise and a prolonged correction. After peaking near $4,278 in mid-2023, rents fell nearly $420 by end of 2024. A brief Q1 2025 rebound—driven by a 3.1% January jump—was wiped out by a 3.5% drop in April.

The contrast is sharp: twelve consecutive months of rent declines in 2024, followed by a short-lived uptick and quick reversal. Annual growth flipped from +4.1% into 2024 to –6.9% into 2025, which might suggest either a lease cycle mismatch, a pricing overcorrection, or deeper demand-side fragility

This volatility might suggest slower, less reliable growth ahead. With affordability constraints rising, even seasonal boosts may not stick, as quick corrections now follow short bursts of momentum.

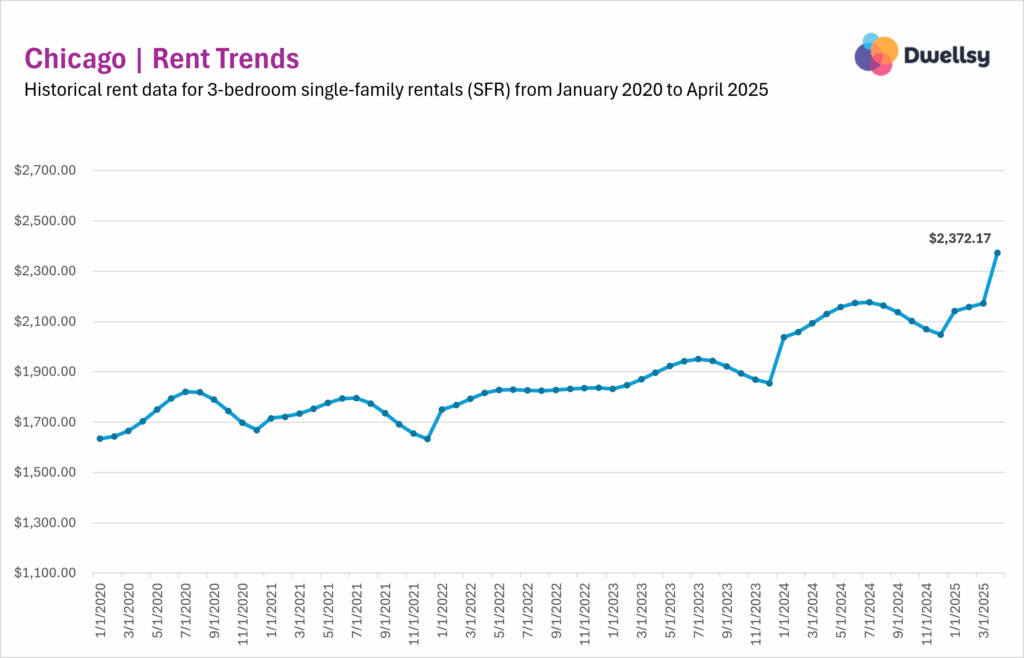

Chicago

Between January 2020 and April 2025, Chicago’s single-family rents climbed steadily, with seasonal swings. After moderate gains in 2022 and 2023, rents surged 7% by July 2024 before dipping for five straight months. Early 2025 brought steady growth, capped by a record 9.2% spike in April.

This volatility stands out even more in the context of month-over-month trends: January 2024 kicked off with a 9.8% jump before correcting late in the year. In 2025, consistent +0.7% gains gave way to April’s breakout, which might be pointing to strong spring demand or delayed pricing shifts. YoY growth held firm at 5.2%, showing continued momentum.

Long term, Chicago might be entering a second wave of growth. While the market shows signs of overheating in bursts, it continues to push higher with fewer signs of stagnation or structural constraint compared to other major cities. The April rebound, in particular, might signal underlying demand strength, though with increased sensitivity to timing and seasonality.

Want more rental data like this?

Access national and local rent trends powered by Dwellsy’s database of over 16 million listings, and get exclusive rental data insights before anyone else.

By subscribing, you agree to our Privacy Policy and Terms of Use.

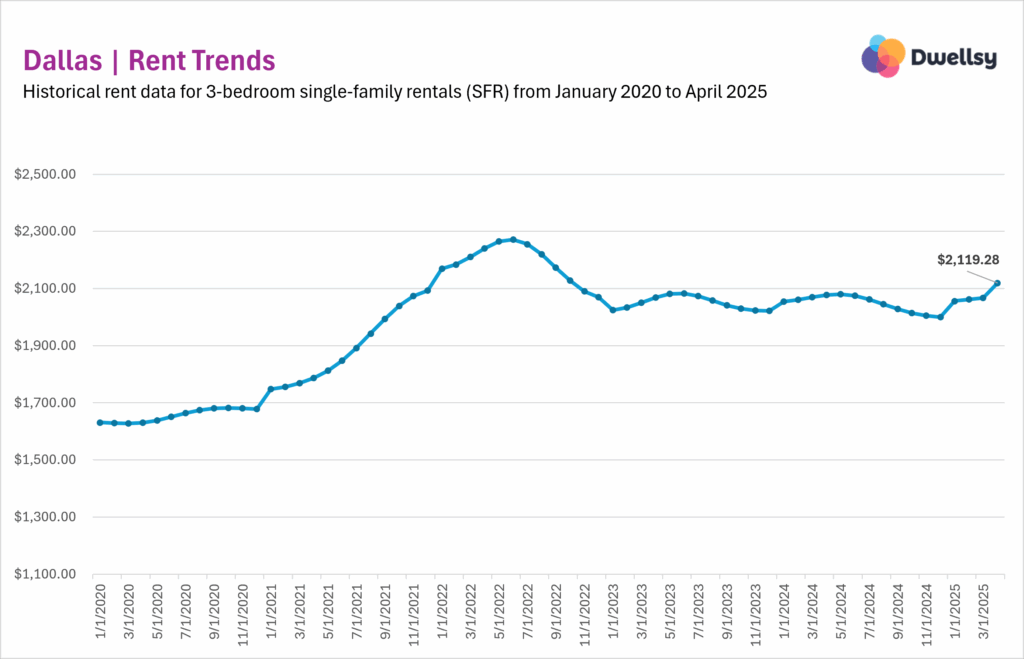

Dallas

Between January 2020 and April 2025, Dallas’s single-family rents rose steadily—up 39% by mid-2022—before cooling into a prolonged plateau. The early surge, driven by post-pandemic demand, peaked around $2,270, then gave way to a soft correction through late 2022 and a narrow band of stability through 2023 and most of 2024.

Seven straight months of mild declines closed out 2024, but the downturn was measured. Early 2025 brought a quiet recovery, with modest gains followed by a 2.5% jump in April, pushing rents to their highest since mid-2022. Month-over-month data shows an orderly cycle of growth, mild corrections, and rebound, avoiding the extremes seen in more volatile metros.

Year-over-year trends mirror that steadiness: a 24.1% jump into 2022, a -6.7% dip into 2023, then modest gains of 1.5% into 2024 and 0.1% into 2025. Dallas now might be in a plateau phase, with gentle upward pressure. Its gradual trajectory reflects strong fundamentals and a market that adjusts smoothly to shifting conditions.

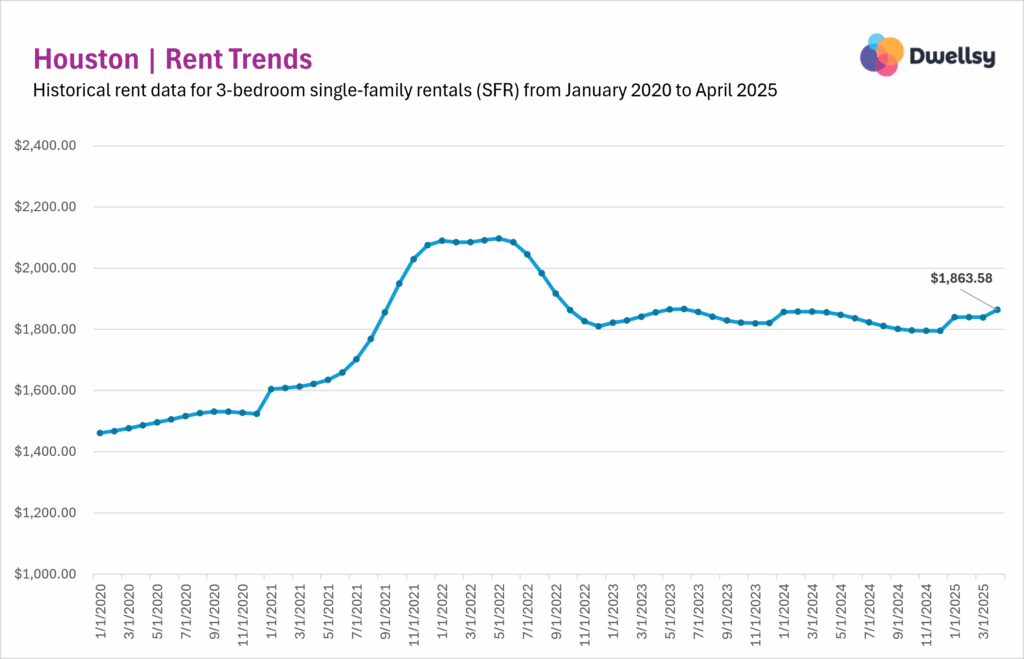

Houston

Between January 2020 and April 2025, Houston’s single-family rental market followed a classic boom–bust–reset pattern. Rents surged over 30% into mid-2022, peaking at $2,096, before correcting through early 2023. By April 2025, rents had settled at $1,863, still about 11% below peak.

Month-over-month data shows muted momentum. A 2.5% lift in January and 1.3% in April 2025 were outliers in an otherwise flat or declining trend since early 2023. Houston’s recovery has been modest compared to the spring spikes seen in Chicago or Dallas. Nine straight months of rent drops in late 2024 underscore the city’s stagnation.

Year-over-year growth backs this up: after a 30.2% surge into 2022 and a 12.8% drop into 2023, rents have moved sideways. While Houston remains affordable and relatively stable, its current plateau might reflect weak demand and limited pricing power.

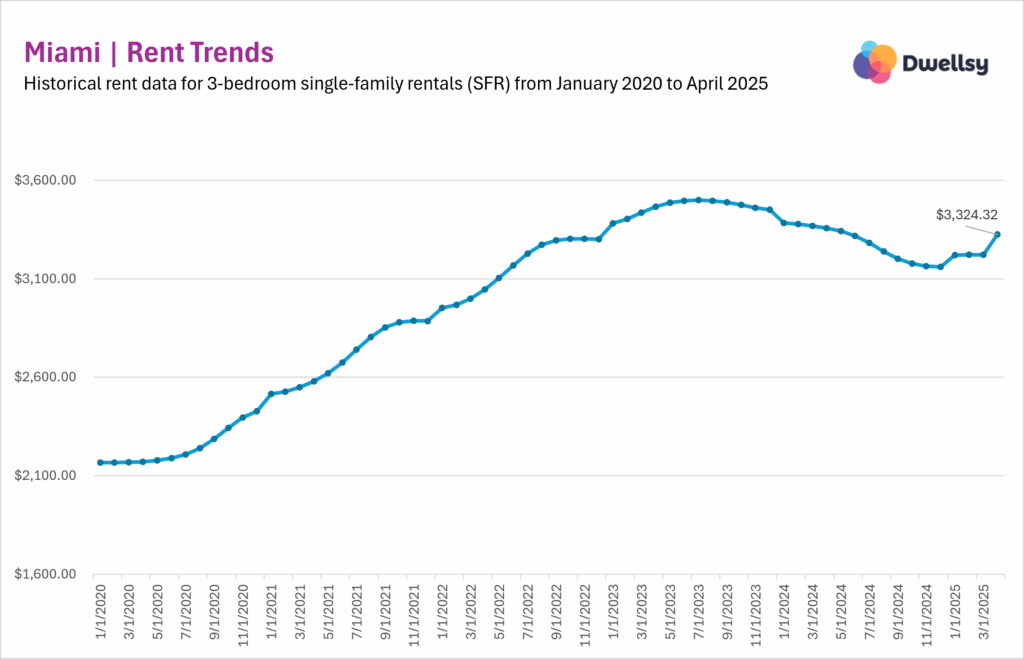

Miami

Between January 2020 and April 2025, Miami’s single-family rents surged over 60%, climbing from just above $2,160 to a peak of $3,498 by July 2023. That explosive growth, which might be driven by migration and tight supply, plateaued by late 2023, then reversed, when rents fell steadily through 2024, declining about 5.5%.

Early 2025 looked stagnant, with flat rents in Q1, until April’s sharp 3.2% spike, hinting at returning seasonal demand or strategic price resets. Still, rents remain roughly 5% below the mid-2023 peak.

Long term, Miami might be entering a more mature, cyclical phase. April’s rebound is significant, but it’s too early to call a recovery. The next few months will reveal whether demand can sustain the shift or if the correction resumes.

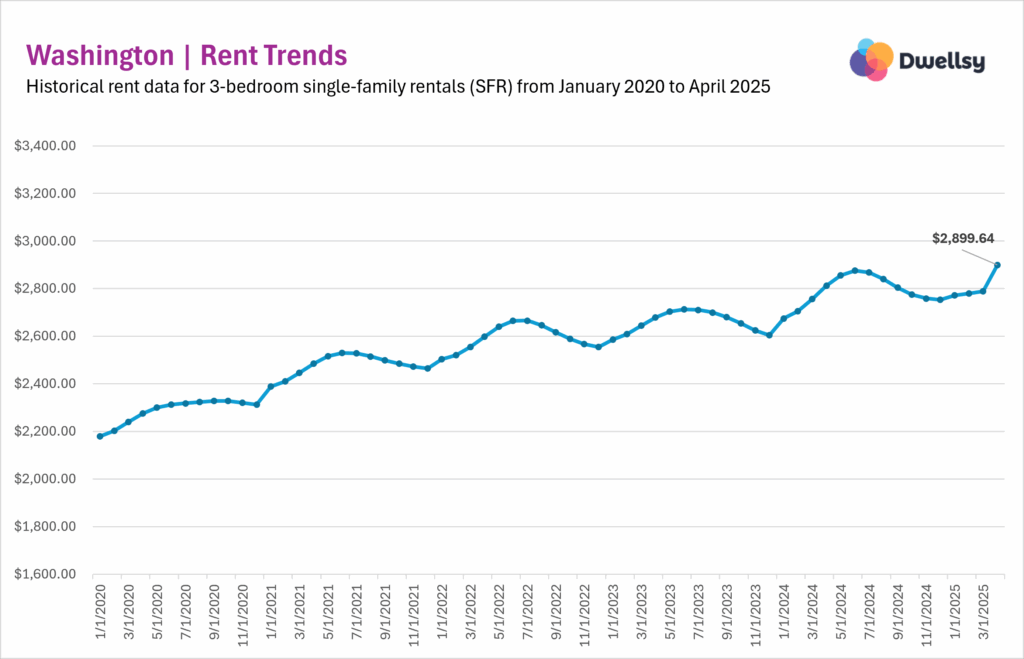

Washington

Between January 2020 and April 2025, Washington’s single-family rental market rose steadily by about 33%, showing some of the most stable gains among major metros. Rents climbed from just over $2,179 to nearly $2,899 without any year-over-year declines.

Seasonal patterns were clear: early-year gains peaked mid-year before easing in the fall. In 2025, momentum returned, and April brought a sharp 4.0% jump, the metro’s strongest monthly gain in a year, likely reflecting peak leasing demand and annual rent resets.

Overall, Washington’s rental market stands out for its resilience, predictability, and low volatility. While other metros cycled through boom-and-bust phases, Washington maintained a controlled upward path, making it a model of long-term market stability in the country.

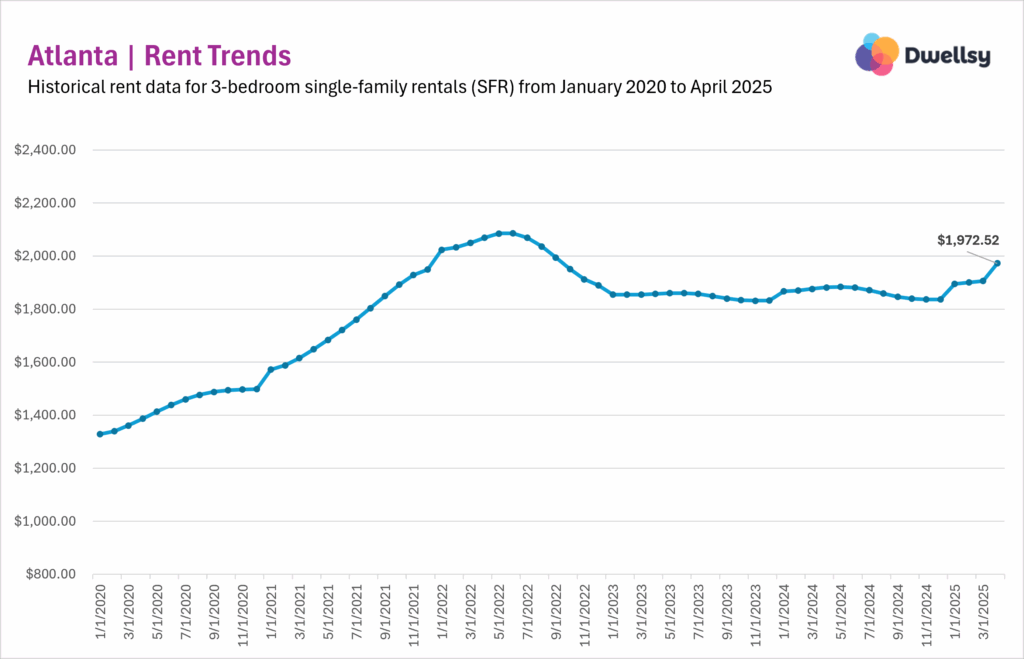

Atlanta

Between January 2020 and April 2025, Atlanta’s single-family rental market experienced a boom–bust–recovery cycle. Rents jumped nearly 60% through mid-2022, peaking above $2,080, before dropping around 9% during a prolonged correction into late 2023. Stabilization followed in 2024, with modest early 2025 gains culminating in a +3.5% spike in April.

This April rebound pushed 2025’s cumulative rent gains to 4.1% by Q2, suggesting that the market may be entering a renewed growth phase. Month-over-month and year-over-year trends point to cautious momentum: Atlanta saw 0.6% YoY growth into 2024 and 1.5% into 2025, reflecting mild recovery after its sharp 2023 contraction.

While still volatile and sensitive to affordability pressures, Atlanta’s market might be finding its footing. If current momentum holds, it could mark the start of a more balanced and sustainable upswing.

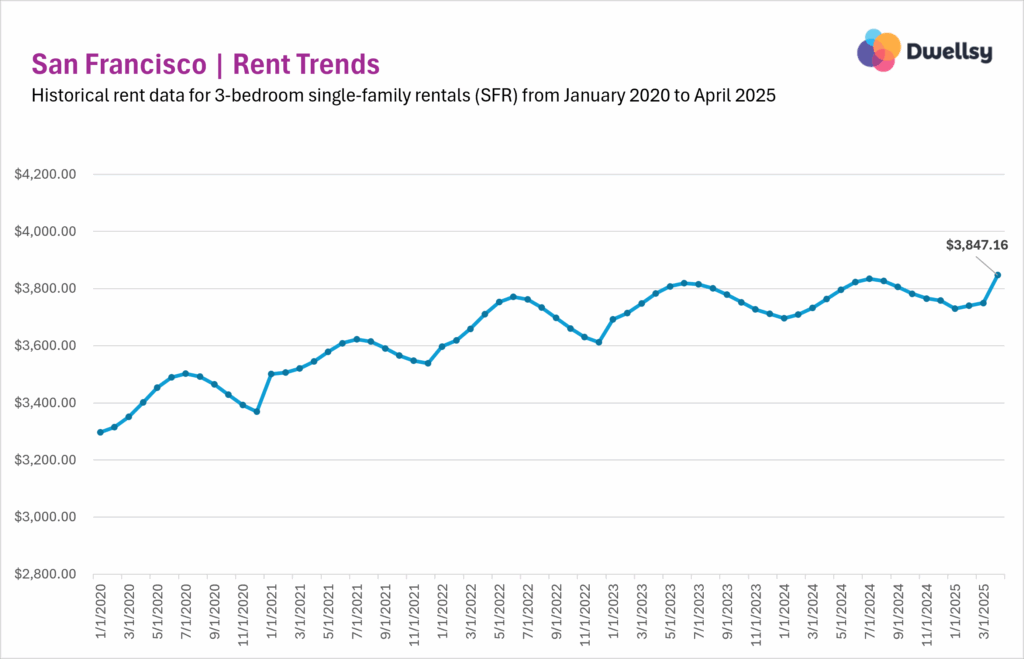

San Francisco

Between January 2020 and April 2025, San Francisco’s single-family rents rose steadily from $3,296 to $3,847, a ~17% gain over five years. Growth stayed positive each year but clearly slowed, with YoY increases falling below 1% from 2023 onward. Monthly patterns followed a consistent rhythm: rising into summer, softening through year-end, and peaking with a +2.6% surge in April 2025.

Even with that April jump, San Francisco remains one of the most stable rental markets, defined by low volatility and predictable seasonality. Q1 2025 was nearly flat, with steady ~0.3% monthly gains – until April broke the pattern with a spike -, echoing past years and contrasting with the swings seen in markets like Chicago or Atlanta.

Overall, San Francisco shows signs of maturity over momentum: high prices, modest growth, and reliable seasonal shifts. April’s spike might signal renewed interest, but the broader trend points to sustained stability, not a breakout.

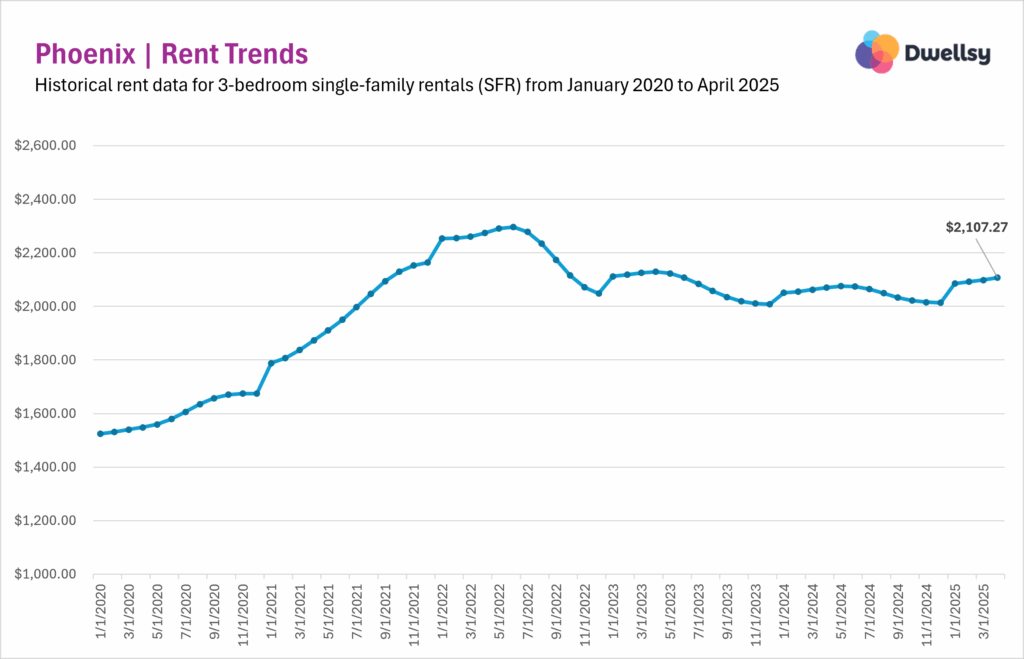

Phoenix

Between January 2020 and April 2025, Phoenix’s single-family rental market experienced extreme swings. After surging 50% in just two and a half years, rents peaked mid-2022 at $2,297 before dropping to $2,007 by late 2023. The decline continued into 2024, with only modest early gains giving way to seven straight months of softening.

Phoenix’s market was nearly flat through Q1 2025, but with an upward curve and a strong +3.5% jump in January, which might reflect seasonal demand. That was followed by modest but steady gains of +0.3% to +0.4% in February through April.

Phoenix remains one of the most volatile metros, marked by rapid rises and steep corrections. While 2025 shows stabilization, the pace of recovery is cautious. This market might be finding its footing again, but it’s far from the explosive growth phase it saw earlier in the decade.