The U.S. multifamily rental market has undergone significant shifts over the past five years, from pandemic-era surges to market corrections and signs of renewed momentum. In this analysis, we explore rent trends for one-bedroom apartments across 10 major metros, using verified data from active listings on the Dwellsy.com Marketplace between January 2020 and April 2025. Dwellsy has more than 16 million units that list when they have availability, so this data set represents over 35% of the overall US rental inventory. This report offers a data-driven snapshot of how these markets have evolved and where they might be heading next.

Table of Contents

Methodology

This report analyzes one-bedroom rental trends in the U.S. multifamily market from January 2020 to April 2025, based on over 16 million vetted Dwellsy listings. We used Gaussian filtering to smooth outliers and tracked month-over-month and year-over-year changes to reveal seasonal and long-term shifts. All insights are drawn from real-time listing data. For visual clarity, chart axes were scaled by subtracting ~500 from the minimum value and adding ~500 to the maximum. See full methodology here.

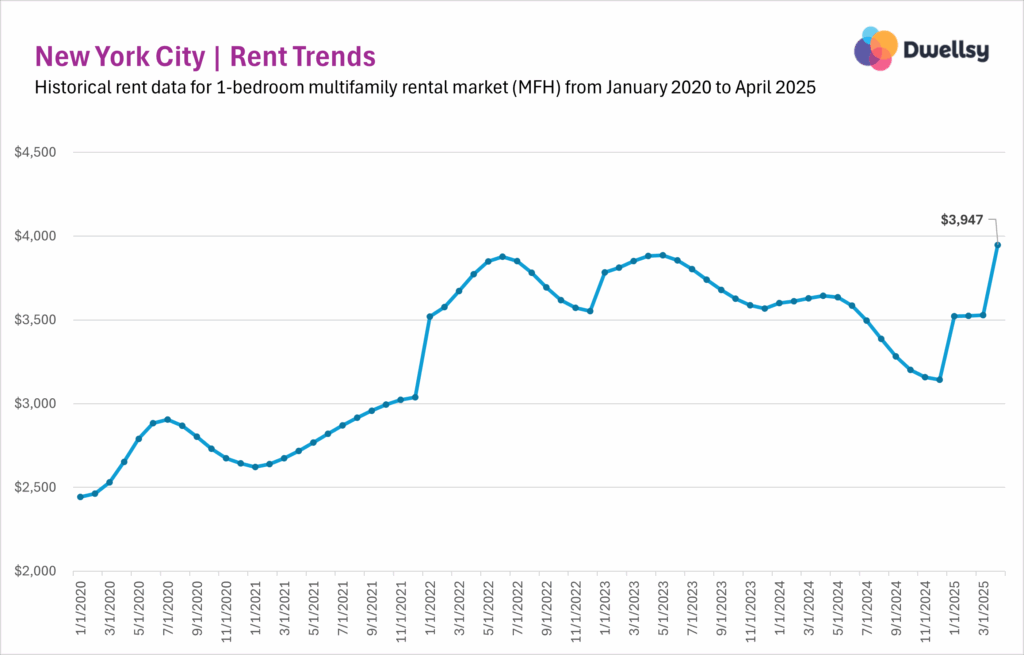

New York City

Between January 2020 and April 2025, New York City’s multifamily rental market followed a classic boom–bust–rebound arc. Rents surged nearly 59%, from $2,444 to $3,878 by mid-2022, then declined through late 2023 and most of 2024.

In early 2025, the market spiked, paused, then spiked again. January’s 12% jump—the sharpest since 2024—pushed rents past their previous high, followed by a brief plateau. April’s additional 11.9% surge set a new peak of $3,947, which might be driven by seasonal demand, repricing, or a supply shift.

Long term, NYC’s market is defined by sharp volatility. Booms and busts happen fast, which might be caused by leasing cycles and pricing power. April’s surge might be a turning point, but whether this marks a true recovery remains uncertain.

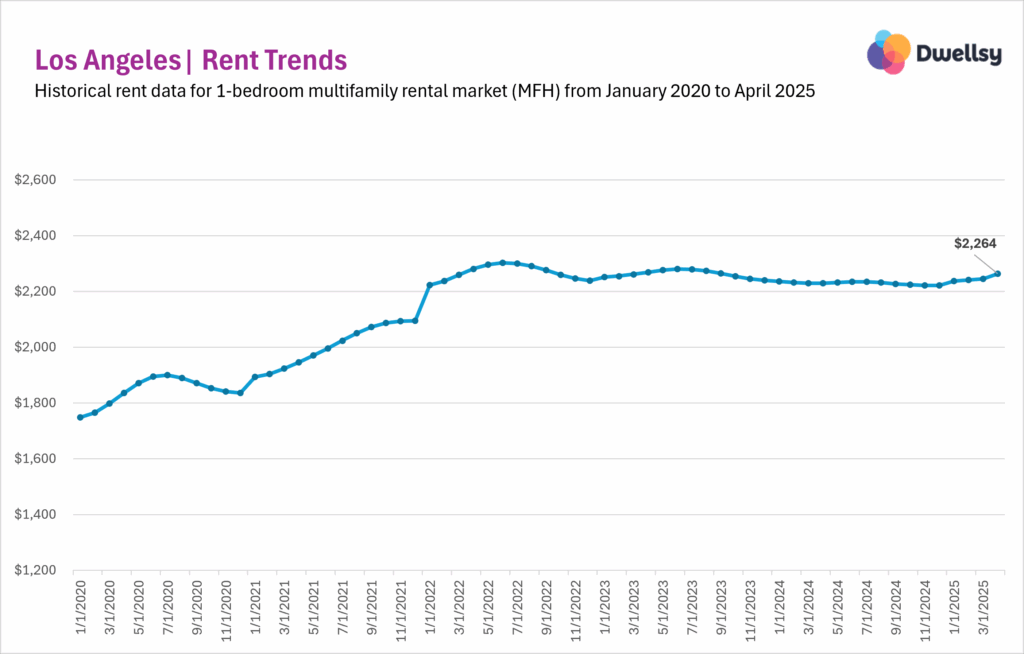

Los Angeles

Between January 2020 and April 2025, Los Angeles’ multifamily rental market rose steadily—up 32% by mid-2022—before settling into a prolonged plateau. Since then, rents have hovered near $2,280, and in 2024, flattened, staying within a narrow $2,222–$2,235 range for 12 straight months.

2025 has brought faint signs of reacceleration. Rents inched up each month from January to April, culminating in a modest +0.8% gain, the strongest month-over-month (MoM) increase in over a year. Overall, after its pandemic era-boom, LA’s rental market is now defined by stability more than volatility.

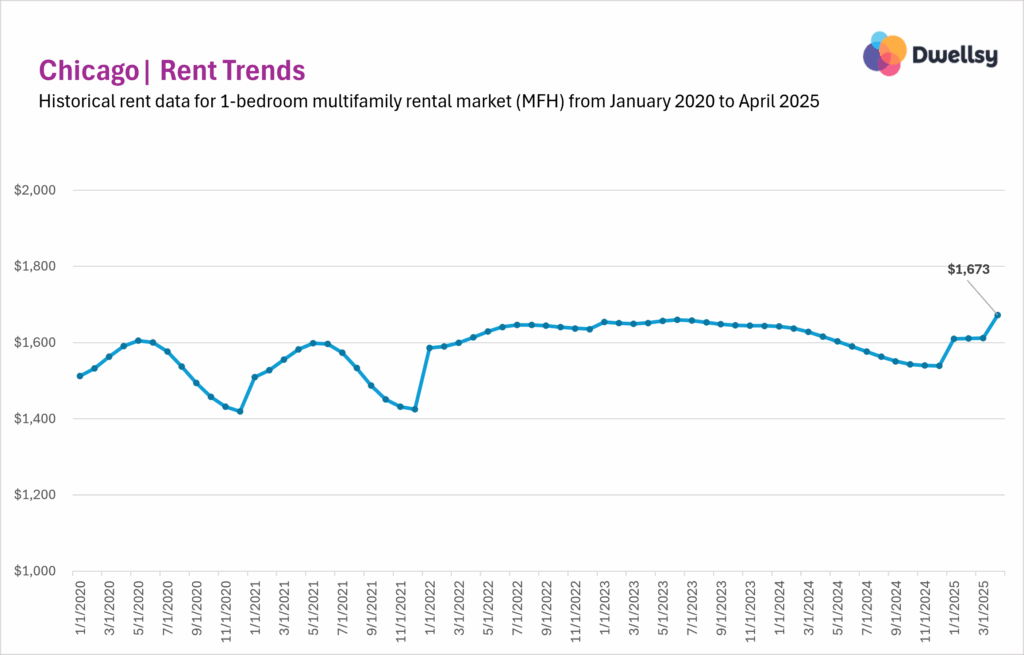

Chicago

Between January 2020 and April 2025, Chicago’s multifamily rental market showed a consistent seasonal rhythm. Rents typically climbed through spring and early summer, then softened into year-end. That pattern held steady until 2024, when the market broke from tradition and entered an extended decline, with eleven straight months of losses.

The first signs of recovery appeared in early 2025. While Q1 remained flat, April brought a +3.8% jump, the sharpest monthly gain in one year.

Chicago remains a stable, lower-cost market with predictable rhythms. Rather than aggressive appreciation, it continues to deliver gentle cycles of growth and contraction, shaped more by seasonal movement than by structural shifts.

Want more rental data like this?

Access national and local rent trends powered by Dwellsy’s database of over 16 million listings, and get exclusive rental data insights before anyone else.

By subscribing, you agree to our Privacy Policy and Terms of Use.

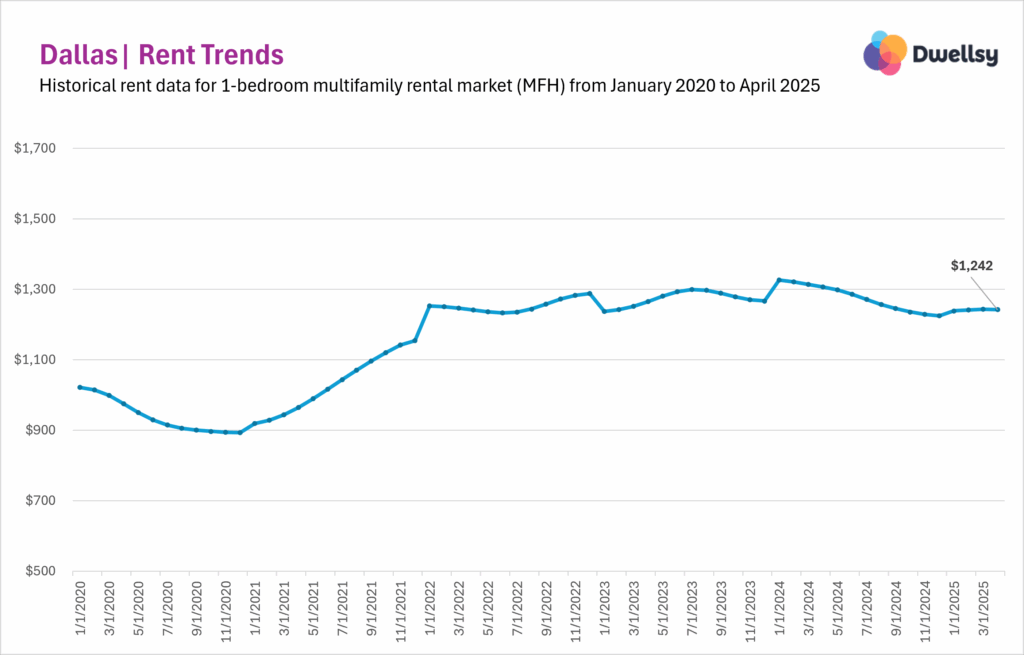

Dallas

Between January 2020 and April 2025, Dallas’ multifamily rental market experienced swings — from early-pandemic losses to a post-COVID surge, followed by correction and stagnation. Rents peaked in January 2024 at $1,326 and declined steadily through the rest of the year.

The first quarter of 2025 brought a modest rebound, with rents climbing slightly each month. But that momentum stalled in April, when rents dipped 0.1%, raising questions about whether the recovery is sustainable.

Rather than a trajectory of sharp gains, Dallas shows alternating early-year surges and corrections. While the volatility has eased in recent years, rent growth has stalled, which might suggest that the market is in a holding pattern, neither accelerating nor fully correcting.

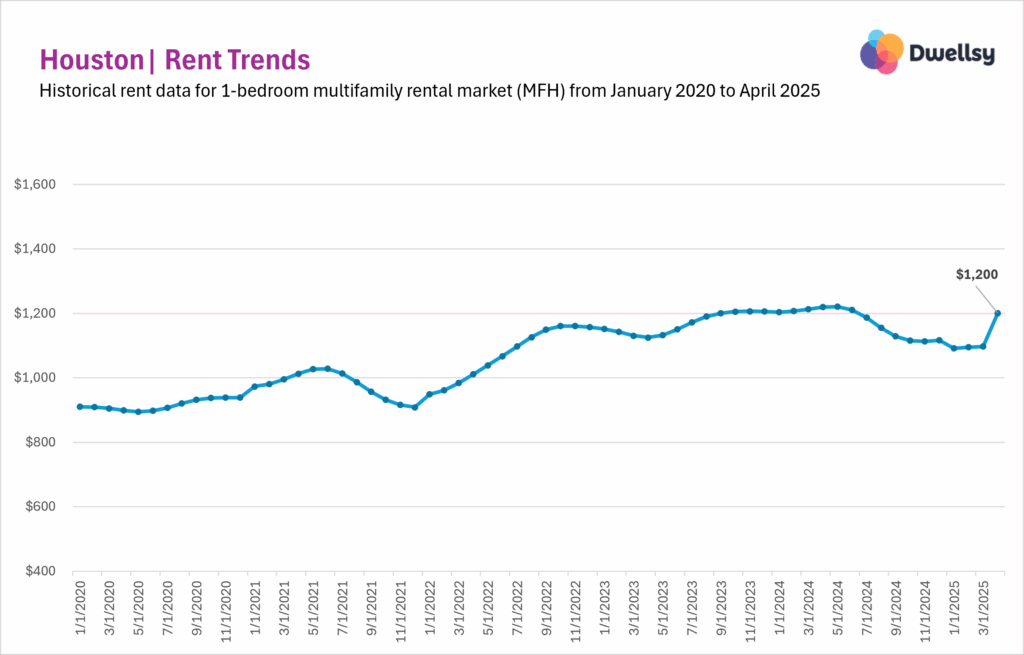

Houston

Between 2020 and early 2024, Houston’s multifamily rental market followed a wave-like rhythm, with extended periods of both increases and decreases. These cycles defined the market’s post-pandemic volatility, with rents reaching their peak in early 2024 after several multi-month swings in both directions.

That peak was followed by seven straight months of decline through the end of 2024. Early 2025 continued that softness — January alone saw a 2.2% drop — until April’s sharp +9.4% spike. The surge might reflect seasonal leasing demand or a sudden pricing reset.

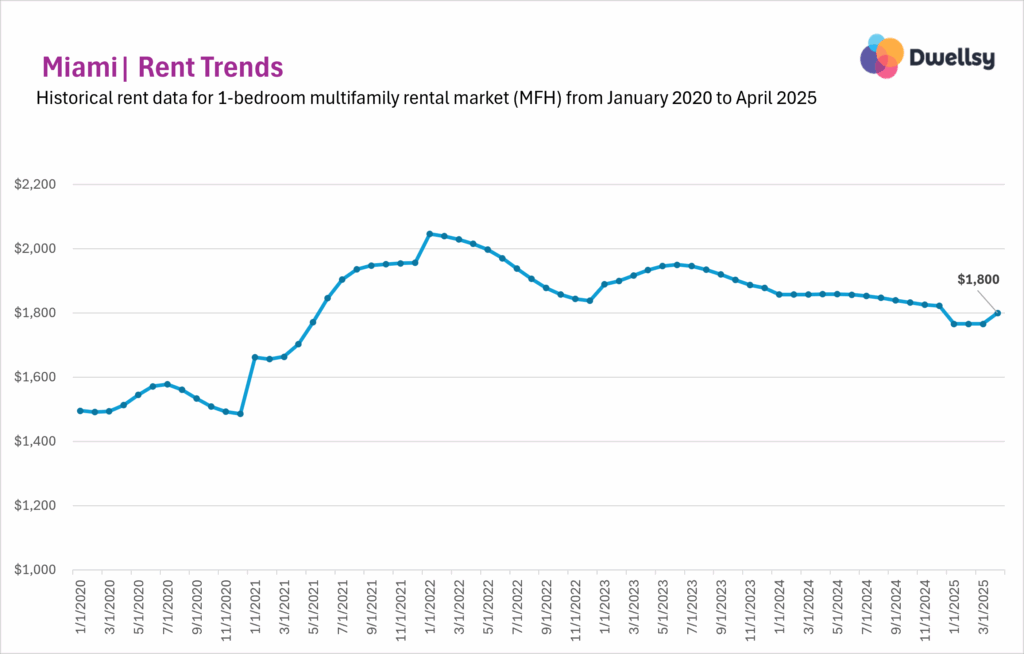

Miami

Between 2020 and early 2022, Miami’s multifamily rental market climbed sharply, with rents jumping from ~$1,500 to just over $2,000 in two years. That surge was followed by a mild correction in late 2022, then another brief rise into mid-2023. Since then, the trend has been mostly downward, with steady declines through 2024, interrupted only by a few flat months.

Q1 2025 saw a -3.1% drop in one month, followed by two months of stagnation, until April brought a +1.9% bump. That rebound brought rents roughly back to early 2024 levels but still below the post-COVID highs.

While April’s jump is notable, it’s too early to call it a recovery. Miami’s rental market might be stabilizing, but it hasn’t regained its former momentum. The market remains below peak, a signal to watch closely as the leasing season unfolds.

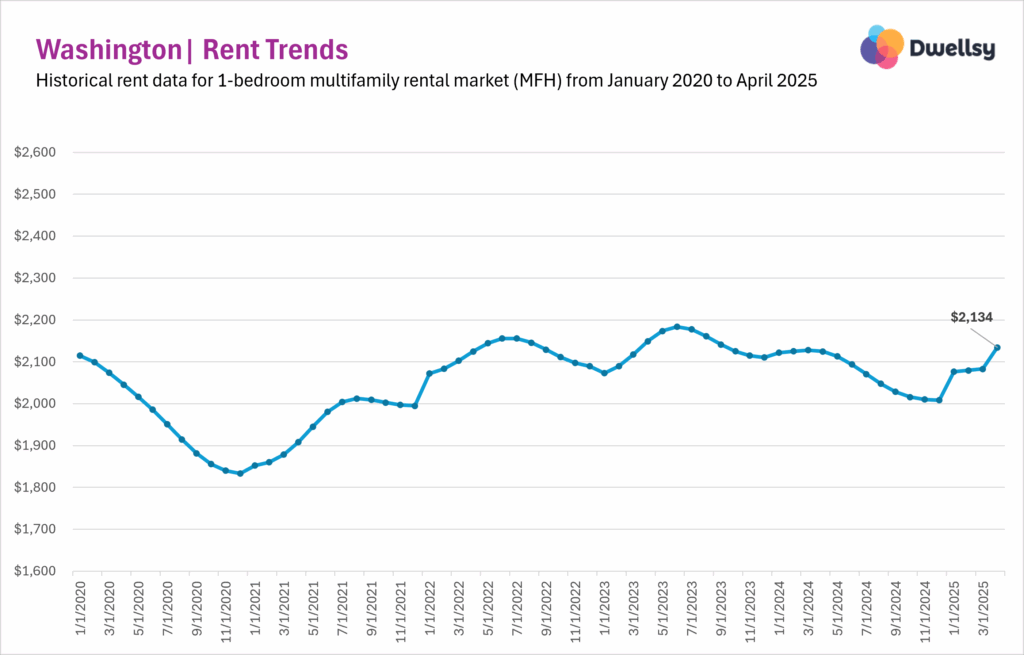

Washington

Washington’s multifamily rental market shows a clear seasonal rhythm: rents typically rise through spring and summer, then decline into year-end. This pattern held true in 2023, though with softer peaks, and again in 2024, when rents dropped for eight straight months, bottoming out by December.

2025 brought signs of recovery: modest early gains followed by a sharp +2.5% spike in April. Whether this rebound continues into summer will reveal if Washington is on a true recovery path or just riding seasonal demand.

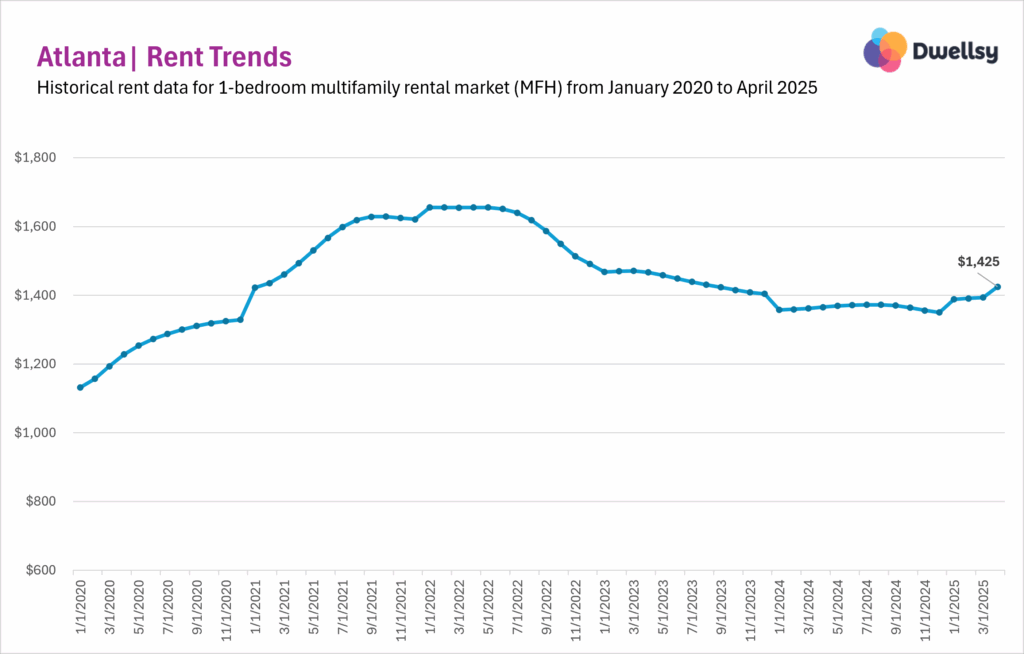

Atlanta

Atlanta’s multifamily market soared through early 2022, then declined nearly 19% over the next two years. Rents bottomed at $1,350 by end-2024 after a long, slow correction.

2025 shows recovery signs, with rents rising each month from January to April, with a +2.3% spike in April, the strongest in 2025. Although still early, the spring surge suggests Atlanta might be turning a corner after years of volatility and contraction.

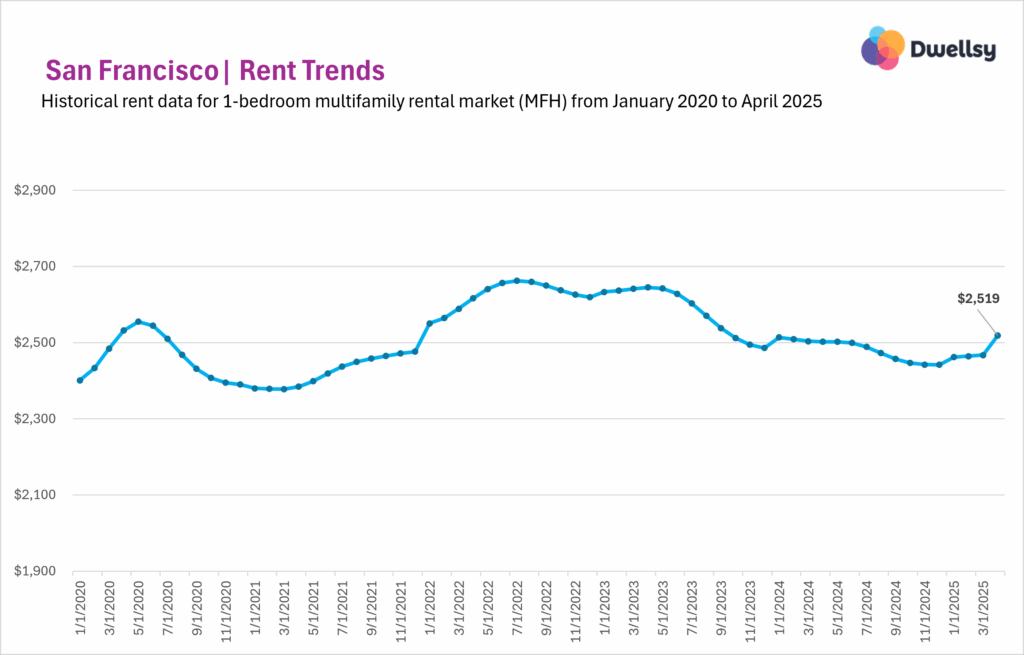

San Francisco

San Francisco’s multifamily market began a slow, steady decline in mid-2022, continuing through late 2023 and all of 2024, reaching a low in December. In early 2025, momentum began to shift — rents ticked up slightly each month in Q1, followed by a sharper +2.1% jump in April.

Despite this rebound, April 2025 rents are only slightly above where they were a year earlier, and the market appears to be finding its footing. While there are signs of seasonal recovery, it might be entering a new plateau instead of gearing up for a major surge.

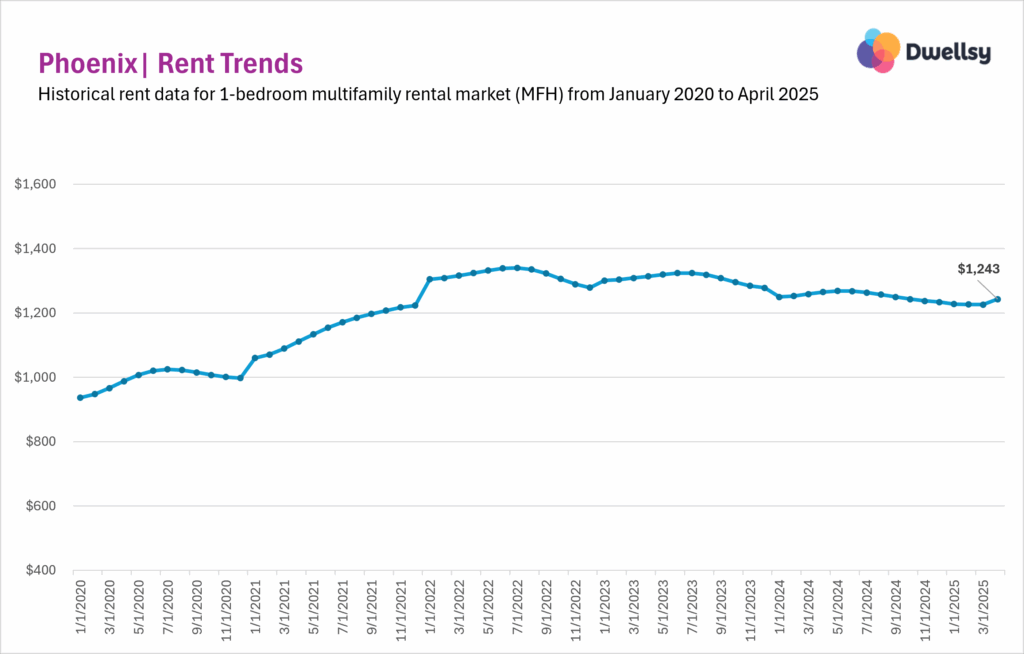

Phoenix

Phoenix’s multifamily market is slowly emerging from a prolonged correction. After a surge from 2020 to mid-2022 — when rents jumped more than 40% — the market plateaued in 2023 and steadily declined throughout 2024. Early 2025 continued that softness, but April’s +1.4% MoM increase stands out as the first meaningful gain in over a year.

That said, the rebound remains modest. With affordability challenges and lingering supply pressure, Phoenix might be stabilizing rather than accelerating.