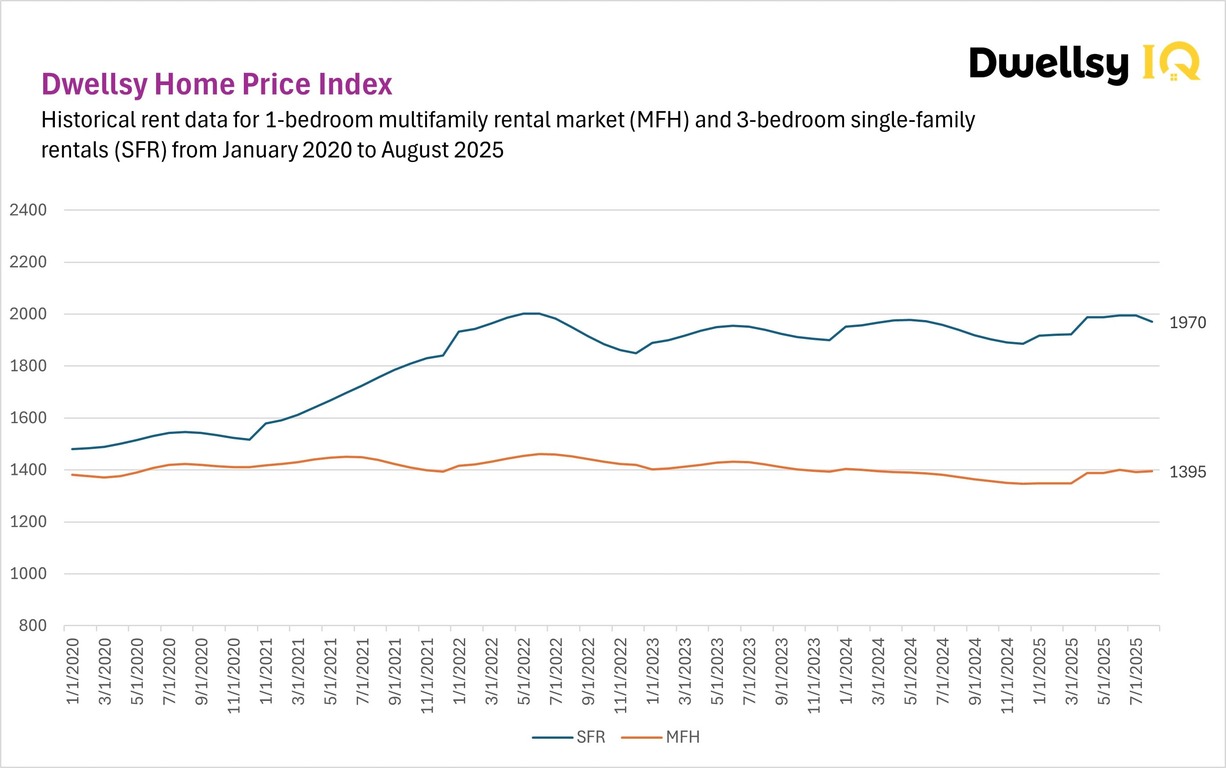

After years of volatility, single-family rentals (SFRs) and multifamily housing (MFHs) have both settled into modest growth, posting near-identical annual gains. Yet beneath this surface stability lies a structural shift: the rent gap between houses and apartments has widened into what might be a lasting divide, underscoring the differences in space, size, and household needs.

Methodology

This report analyzes national rental trends in both the single-family rental (SFR) and multifamily housing (MFH) markets, focusing on three-bedroom homes for SFR and one-bedroom apartments for MFH. Drawing from the more than 16 million rentals that list on the Dwellsy.com Marketplace, the dataset represents real-time market behavior rather than projections or survey estimates. All data was vetted for accuracy and processed using a Gaussian filtering method to smooth outliers while preserving genuine market shifts. These insights are based entirely on observed listings, ensuring that the results reflect actual market activity as it occurs. For details on data preparation, quality controls, and analytical techniques, see the full methodology.

Year-over-Year

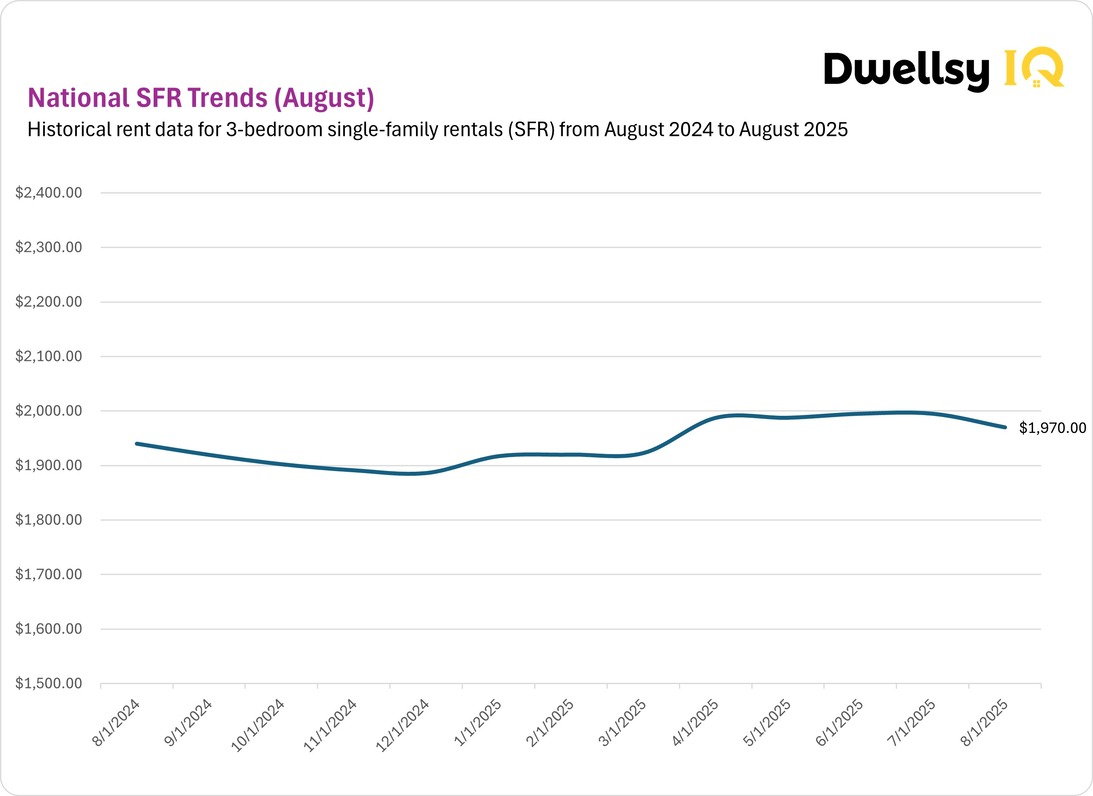

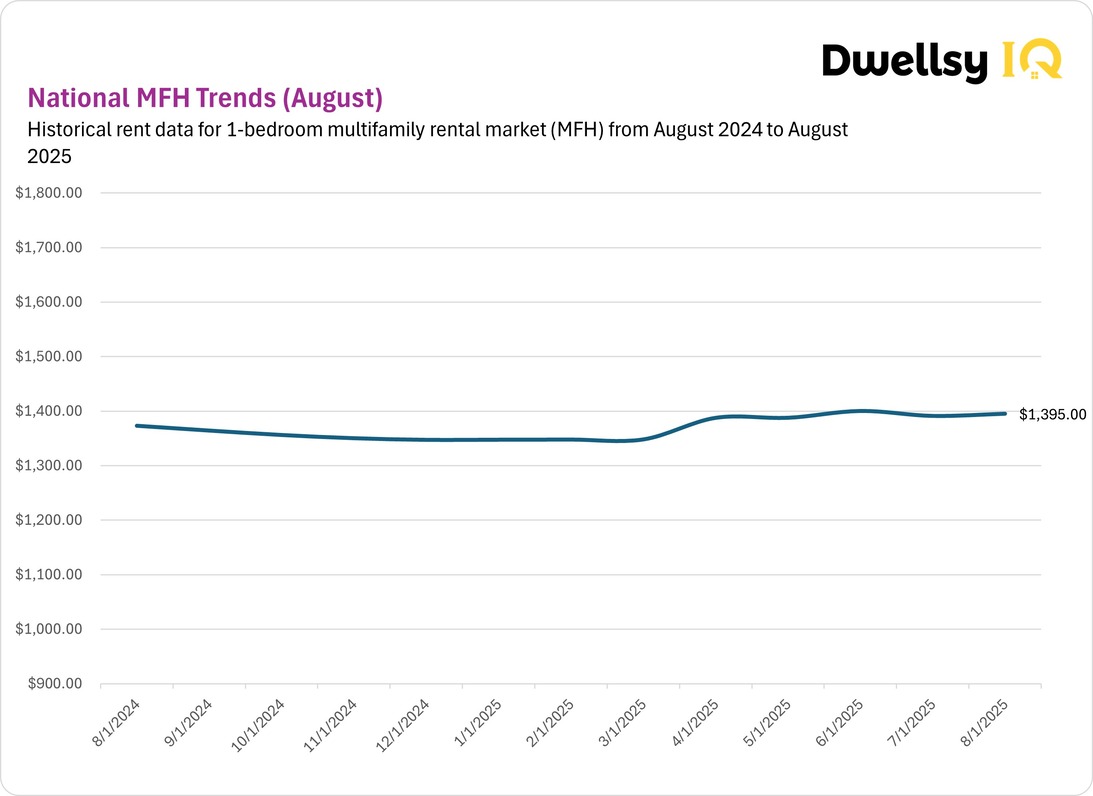

Over the 12 months, SFRs rose modestly from $1,940 to $1,970, a +1.5% YoY increase. Meanwhile, MFHs increased from $1,373 to $1,395, a +1.6% YoY increase.

Month-to-Month

Single-family rents fell slightly through late 2024, dipping from $1,940 in August to $1,886 in December, before rebounding in the spring of 2025. They peaked at $1,995 in June and July before easing back to $1,970 by August. Multifamily rents, in contrast, remained almost flat: $1,373 in August 2024, $1,347 in December, peaking at $1,400 in June before slipping to $1,395 by August 2025.

Conclusion

In conclusion, the August 2025 snapshot shows a year of stability, with both SFRs and MFHs posting modest gains of around 1.5%. After the volatility of previous years, the market now appears to be moving on a steadier path.