Economic uncertainty has been the backdrop of 2025, but with mixed signals everywhere, one question keeps resurfacing: are we already in a recession? While some indicators remain stable, others are flashing warning signs. From job slowdowns and rising delinquencies to weak rent growth and surging debt costs, the data suggests the U.S. economy may be slowing more than it appears.

In this article, we’ll look at the key indicators shaping the conversation: state-level contractions, consumer struggles, and the subtle but significant rent trends from Dwellsy that add more context to the story.

State data shows that half the U.S. may already be in recession

Mark Zandi, Chief Economist at Moody’s Analytics, recently released a state-by-state economic analysis that paints a divided picture. According to his findings, about half of U.S. states are now in recession, including major players such as Virginia, Washington, and Illinois.

New York and California, meanwhile, are “treading water.” Zandi warned that if either state tips into contraction, it could be enough to push the national economy into a technical recession.

This uneven slowdown highlights how regional economies have been diverging since the pandemic, with manufacturing-heavy and tech-dependent states showing the sharpest declines.

Auto loan delinquencies at 20-year high

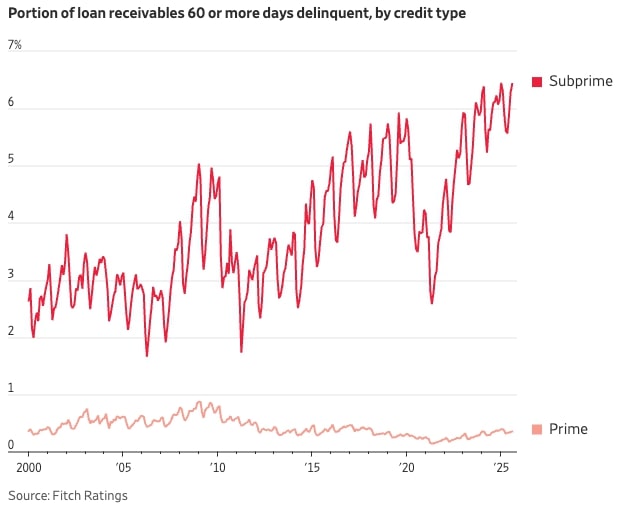

One of the strongest signals of consumer strain comes from Fitch Ratings, which reports that Americans are falling behind on auto payments at the highest rate in over 20 years.

Subprime auto delinquencies have climbed above 6%, a record high since Fitch began tracking the data. For households already managing inflation and high borrowing costs, these missed payments signal financial fatigue.

Consumer health matters more than ever, after all, personal spending drives nearly 70% of U.S. GDP. When households tighten budgets, the effects ripple across nearly every sector.

Job growth weakens

With official jobs data delayed, private estimates from The Carlyle Group, Bank of America, and Goldman Sachs are filling the gap. Unfortunately, those figures aren’t encouraging.

Carlyle’s “shadow” labor report shows only 17,000 new jobs added in September 2025, one of the weakest months in recent years. Both Goldman and Bank of America flagged similar softness, calling it early evidence of a “labor recession.”

Hiring slowdowns often appear before broader recessions, suggesting that businesses are becoming more cautious as uncertainty grows.

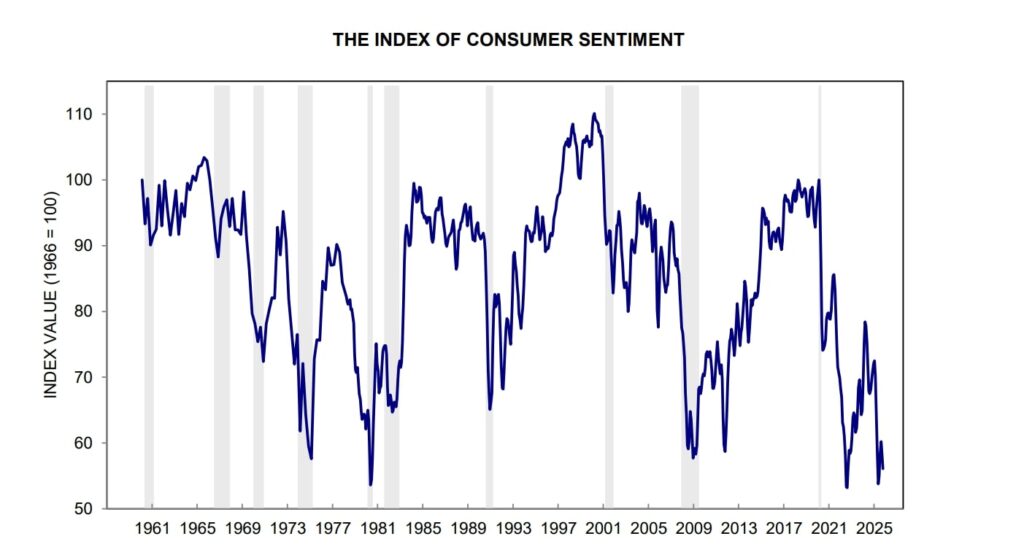

Consumer confidence near a 50-year low

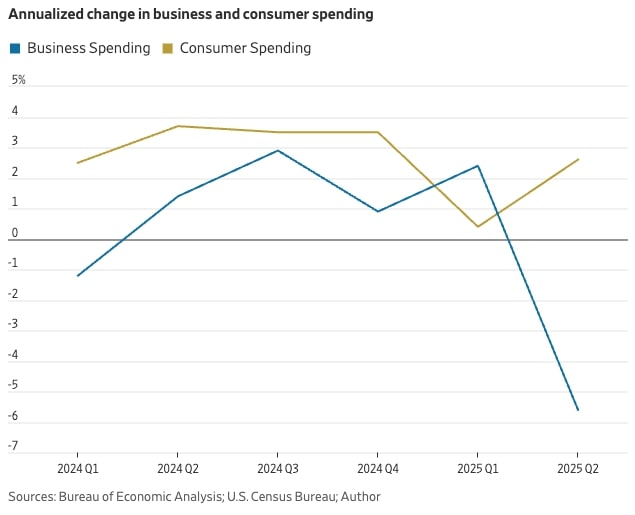

The University of Michigan’s Consumer Sentiment Index remains stable, but only just. It continues to hover near a five-decade low, showing that optimism hasn’t recovered even as inflation cools.

Meanwhile, The Wall Street Journal’s Mark Skousen points out a worrying divergence: business spending is slowing, but consumer spending hasn’t yet followed. That imbalance, of consumers carrying the economy despite pessimism, hasn’t been seen since 2008.

U.S. debt interest surpasses $1 trillion

Interest on the U.S. national debt has surpassed $1 trillion per year, marking a new milestone in federal spending. Today, more than 20 cents of every tax dollar goes toward debt service.

That growing burden limits fiscal flexibility and underscores how rising interest rates continue to reshape public and private balance sheets alike.

Rent growth slows below inflation

According to Dwellsy’s August 2025 data, national rents are technically up, but barely. Rents for 3-bedroom single-family rentals (SFRs) increased 1.5% year-over-year to $1,970/month, and rents for 1-bedroom apartments rose 1.6% 1.6% to $1,395/month.

These modest gains lag behind the 2.9% inflation rate, meaning landlords are effectively losing ground in real terms. The rent data suggest a cooling housing market, which is a sharp contrast to the explosive growth of the past few years.

Animal Spirits effect

Despite these warning signs, sentiment indicators like the Conference Board’s Consumer Confidence Index ticked up slightly in September 2025 to 101.7, from 99.8 in August.

That rise suggests optimism persists, particularly among higher-income households and service-sector workers. Economists refer to this divergence between confidence and data as the “animal spirits” effect, where human optimism sustains spending even when fundamentals weaken.

Whether this resilience lasts will determine if the U.S. experiences a soft landing or slips into a full-blown recession by mid-2026.

Conclusion

The numbers don’t lie: growth is slowing across multiple fronts. Half the states are already contracting, consumers are struggling with record-high delinquencies, and rent growth has dropped below inflation. Yet spending hasn’t collapsed. Well, at least not yet.

If consumer confidence continues to hold, the U.S. might avoid a technical recession. But if employment weakens further or household debt keeps rising, 2025 could mark the turning point toward a national downturn.

FAQ

What happens if we go into a recession?

If the U.S. enters a recession, GDP typically contracts, unemployment rises by 1–2 percentage points, and consumer spending drops 3–4% on average. Historically, recessions last between 6 and 18 months, though their severity depends on credit conditions and policy responses.

What is a recession?

A recession is defined by two consecutive quarters of negative GDP growth or a significant decline across major indicators: employment, real income, industrial production, and retail sales. The National Bureau of Economic Research (NBER) formally determines when one begins and ends.

Will there be a recession in 2025?

Analysts remain cautious but increasingly optimistic. Moody’s Analytics still estimates roughly a 35% chance of a national recession by the end of 2025, while Goldman Sachs recently lowered its probability to 25%, citing stronger labor-market resilience and moderating inflation. The CBO’s latest forecast (September 2025) also projects continued positive growth, around 1.4% real GDP expansion for the year , suggesting that the U.S. economy is slowing, not contracting. In other words, parts of the country may still experience “rolling recessions” across individual states or sectors, but a broad, nationwide downturn now appears unlikely.

Will a recession hit in 2026?

Earlier forecasts had suggested the possibility of a mild recession in early 2026, driven by persistent inflation and weak business investment. However, the Congressional Budget Office’s (CBO) most recent projections, released in September 2025, indicate that a recession is now unlikely. The agency expects real GDP to grow by 2.2% in 2026, supported by stronger consumer spending and investment incentives introduced through the 2025 Reconciliation Act. If inflation continues to ease and the Federal Reserve maintains its gradual rate cuts, the U.S. could achieve a soft landing, slowing without sliding into a downturn.