Dwellsy IQ has released its 2026 Rental Housing Index, a data-driven analysis of rental price movements across the United States based on observed asking rent data through the end of calendar year 2025. Produced in partnership with Briggs Advisors, the report analyzes rental trends using Dwellsy’s first-party dataset of more than 17 million units listings sourced directly from over 25,000 property managers nationwide.

The Rental Housing Index examines pricing patterns for two of the most common rental housing types — three-bedroom houses and one-bedroom apartments — providing both a national view of rent trends and market-level comparisons across major U.S. metropolitan areas.

The findings show a rental market that has moved away from the extreme volatility of the early 2020s and into a more balanced phase, though outcomes varied across property types and markets.

Download the 2026 Rental Market Report

This article covers only part of the trends observed in 2025. Download the full 2026 Rental Market Report, reviewing 2025 rental market performance, for complete national and metro-level analysis across U.S. apartment markets.

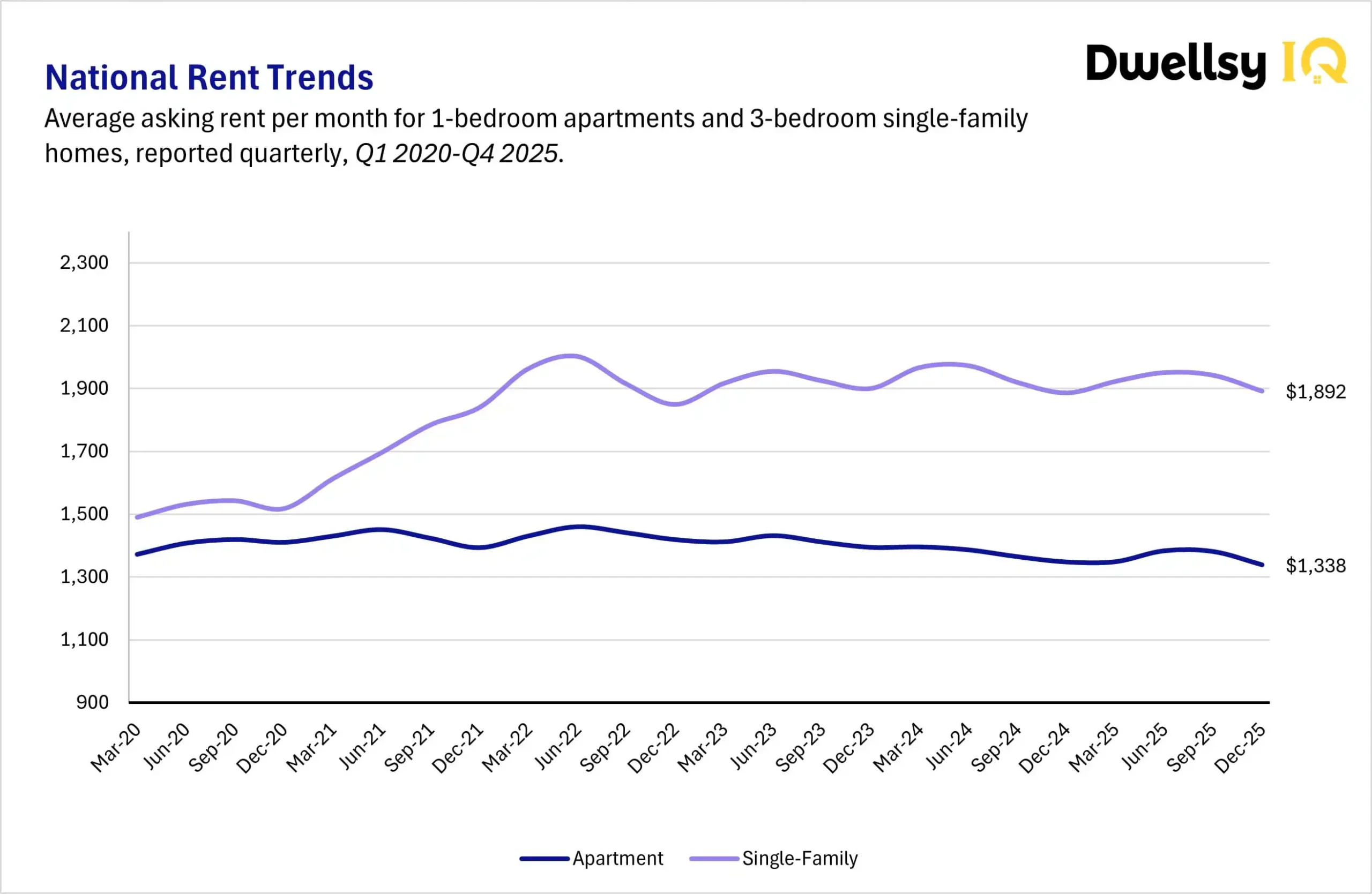

National Rental Trends

Nationally, rents for three-bedroom houses averaged $1,892 at the end of 2025, representing a modest 0.3% year-over-year increase. The data indicate that house rents have largely stabilized following sharp increases earlier in the decade, with rent movement returning closer to typical seasonal patterns. Whether this stabilization transitions into renewed growth will depend on how affordability constraints, supply conditions, and broader economic factors evolve into 2026, as discussed in whether house rents may rise again as market conditions evolve.

Apartment rents followed a different trajectory. One-bedroom apartments averaged $1,338, declining 0.7% year over year and marking the second consecutive year of falling apartment rents. The decline reflects continued adjustment following the pandemic-era surge, as new supply deliveries and affordability constraints limited rent growth in many markets, with apartment performance diverging significantly across metros and continuing to raise questions about why apartment rents declined for a second consecutive year and whether apartment rent growth may return in 2026.

Because these unit types represent the most common forms of rental housing in the U.S., they serve as reliable indicators of broader rental market direction.

Diverging Market Performance

While national averages point to moderation, metro-level results reveal significant variation in performance.

In the house rental market, several large metropolitan areas recorded stronger rent growth in 2025, including Chicago, New York, and Washington, D.C., placing them among the U.S. cities where house rents are rising the fastest, while markets such as Denver, Boston, and Phoenix experienced declines and ranked among the U.S. cities that saw the biggest house rent declines. These differences reflect local supply conditions, affordability pressures, and economic dynamics unique to each metro.

Apartment rent trends also varied widely by market. Some metros recorded positive year-over-year growth and ranked among the U.S. cities where apartment rents are rising the fastest, while others continued to experience declines as recently delivered inventory placed downward pressure on pricing, placing them among the U.S. cities that saw the biggest apartment rent declines.

FAQ

What is the Dwellsy IQ Rental Housing Index?

The Dwellsy IQ Rental Housing Index is a data-driven analysis of rental price movements across the United States based on observed asking rent data. The report analyzes rental trends using Dwellsy’s first-party dataset of more than 17 million unit listings sourced directly from over 25,000 property managers nationwide.

What rental housing types are included in the Rental Housing Index?

The Rental Housing Index examines pricing patterns for two of the most common rental housing types in the United States: three-bedroom houses and one-bedroom apartments. These unit types provide both a national view of rent trends and market-level comparisons across major U.S. metropolitan areas.

What does the 2026 Rental Housing Index show about the rental market?

The findings show a rental market that has moved away from the extreme volatility of the early 2020s and into a more balanced phase, although outcomes varied across property types and markets.

What happened to house rents in 2025?

Nationally, houses averaged $1,892 at the end of 2025, representing a 0.3% year-over-year increase. The data indicate that house rents largely stabilized following sharp increases earlier in the decade, with rent movement returning closer to typical seasonal patterns.

What happened to apartment rents in 2025?

Apartment rents averaged $1,338 at the end of 2025, declining 0.7% year over year and marking the second consecutive year of falling apartment rents. The decline reflects continued adjustment following the pandemic-era surge, as new supply deliveries and affordability constraints limited rent growth in many markets.

Did rental performance vary by city in 2025?

Yes. While national averages showed moderation, metro-level results varied significantly. Some markets recorded stronger rent growth, while others experienced declines, reflecting differences in local supply conditions, affordability pressures, and economic dynamics across metropolitan areas.