The Evolution of the Rental Market from 2020 to 2024: Apartments vs. Single-Family Homes

Over the past five years, the rental market for both apartments and single-family homes has seen significant shifts. Using data from Dwellsy IQ, we analyze how rents have changed from January 2020 through December 2024 and what factors have driven these changes. This comprehensive comparison provides insights into how the overall rental market has evolved and what trends are shaping the future of housing.

The Initial Impact of 2020: Pandemic Disruptions

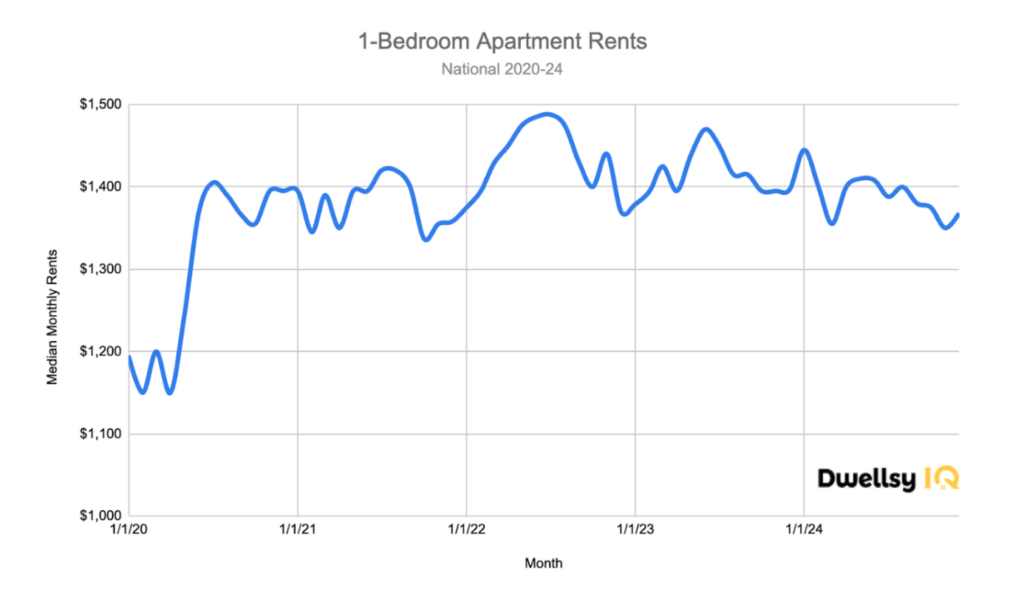

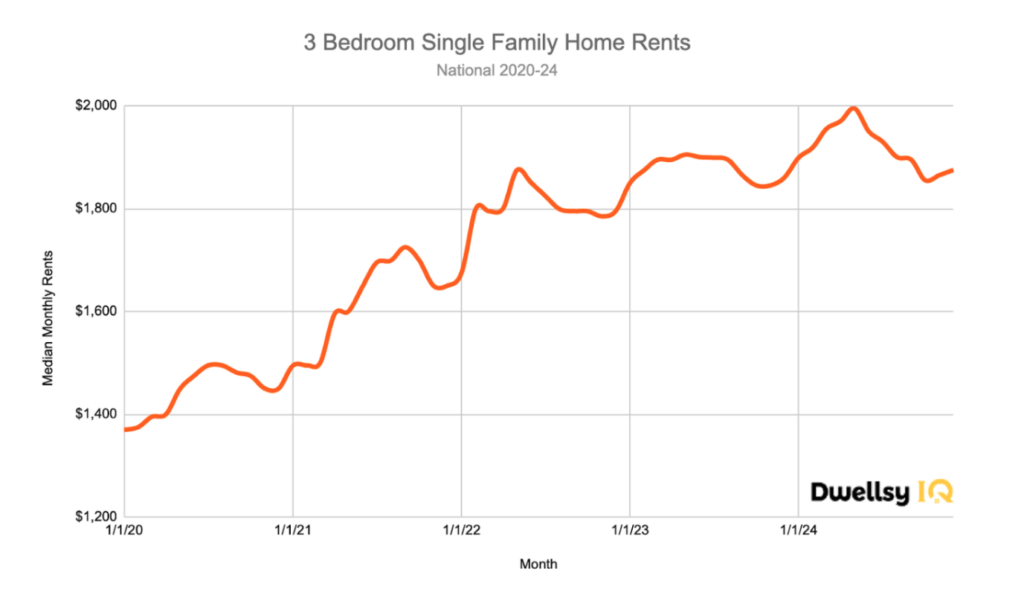

At the start of 2020, rental prices for both apartments (represented by 1-bedroom units) and single-family homes (represented by 3-bedroom units) were relatively stable. The median rent for apartments was $1,195 in January, while single-family homes started at $1,370. However, as the pandemic unfolded, rental trends diverged.

By mid-2020, apartment rents climbed to $1,369, with a peak of $1,405 in July before stabilizing. Meanwhile, rents for single-family homes saw an even greater surge, hitting $1,495 by mid-year. The disparity highlights how larger homes became more desirable as remote work and home-schooling became the norm, increasing demand for more space.

During this period, vacancy rates in urban apartment buildings increased as tenants left dense city centers in favor of suburban and rural areas. This shift in renter preferences reshaped the housing landscape, leading to stronger demand for single-family home rentals and keeping apartment rents in check.

Recovery and Stabilization in 2021

2021 saw a stabilization in the rental market but with a stronger upward trajectory for single-family homes. While apartment rents fluctuated between $1,345 and $1,420, single-family home rents rose significantly, surpassing $1,600 by mid-year and peaking at $1,725 in September. This steeper climb reflected increased competition for single-family rentals as renters prioritized space and privacy.

The apartment market, on the other hand, saw a more gradual recovery. Many landlords offered concessions, such as reduced rent or waived fees, to attract tenants back to urban areas. As remote work policies evolved, some renters began returning to city living, but demand remained stronger for larger suburban properties.

2022: The Year of Inflation-Driven Rent Surges

Inflation and supply constraints led to drastic rent increases in 2022. The median rent for apartments reached $1,488 in July before seeing a slight correction. Meanwhile, single-family homes saw a steeper increase, reaching $1,875 in May, reflecting a shift in demand for larger rentals as homeownership remained unaffordable for many.

The contrast in rent increases between the two categories demonstrates how affordability played a role in renters’ decisions. Those who couldn’t afford larger homes opted for apartments, keeping demand strong in that segment while pushing single-family home rents even higher. Additionally, housing construction delays and supply chain disruptions prevented new inventory from easing price pressures, further escalating rental costs.

Volatility in 2023: A Market in Flux

2023 was characterized by rental volatility across the board. Apartment rents fluctuated between $1,395 and $1,470, while single-family homes hovered between $1,850 and $1,900. Rising interest rates and job market uncertainties contributed to market instability.

As home-buying became less feasible for many due to higher mortgage rates, rental demand remained strong. However, affordability concerns led to some price corrections, particularly in the latter half of the year. Renters who had initially sought single-family homes began reconsidering apartments as a more budget-friendly alternative.

Additionally, as some companies mandated office returns, the demand for urban rentals rebounded slightly, helping to stabilize apartment rents. However, the rising cost of living continued to challenge affordability across all rental types.

2024: A Return to Market Stability

In 2024, both markets showed signs of stabilization, albeit at different price levels. Apartment rents settled around $1,400, while single-family home rents peaked at $1,995 in May before declining slightly to $1,875 by December.

Affordability constraints became a defining factor, leading more renters to opt for smaller units. The widening gap between apartment and single-family home rental prices suggests a growing divide in rental affordability, with smaller units becoming the more viable option for many households.

Additionally, rental trends in 2024 reflected a shift toward hybrid living, with renters seeking locations that balance affordability, space, and proximity to work hubs. This has led to increased rental activity in secondary cities and suburban areas.

Key Market Takeaways

- Pandemic-Induced Demand Shifts: While the rental market for both housing types saw increases, single-family homes experienced a stronger surge as families prioritized space during remote work and schooling.

- Inflationary Pressures: The sharpest rent increases occurred in 2022 due to inflation and housing supply shortages. However, the impact was more severe for single-family rentals.

- Economic Uncertainty and Adjustments: 2023 and 2024 saw price fluctuations as the market adjusted to changing economic conditions, including rising interest rates and affordability concerns.

- Comparative Rent Growth: The rental increases for single-family homes have been more dramatic than those for apartments. As a result, affordability constraints are pushing more renters toward smaller apartments.

- Future Market Trends: While demand for larger rentals remains strong, affordability will continue to be a critical factor. Apartments may see sustained demand as renters look for cost-effective housing options.

- Hybrid Work and Location Flexibility: The shift toward hybrid work arrangements has led to increased demand for rentals in secondary and suburban markets, allowing renters to balance work and lifestyle priorities.

Looking Ahead: What’s Next for the Rental Market?

As we move into 2025, rental prices for both apartments and single-family homes will continue to be influenced by economic policies, housing supply, and shifting workforce dynamics. Remote work trends, interest rate fluctuations, and government housing policies will play key roles in shaping future rental trends.

Potential zoning reforms, rent control measures, and new housing developments could impact rental affordability. Developers are likely to focus on multi-family housing projects to meet growing demand for smaller, more affordable units.

For renters, staying informed about local market trends will be essential in securing affordable housing. Landlords, in turn, must adjust their offerings to meet evolving tenant needs, whether that means offering flexible lease terms, adding amenities, or targeting specific renter demographics.

Ultimately, the rental market remains dynamic, with affordability, supply constraints, and economic factors playing critical roles. Both apartments and single-family home rentals will continue to be shaped by broader macroeconomic trends, making adaptability key for both renters and property owners alike. For the latest rental data and insights, visit DwellsyIQ.com.