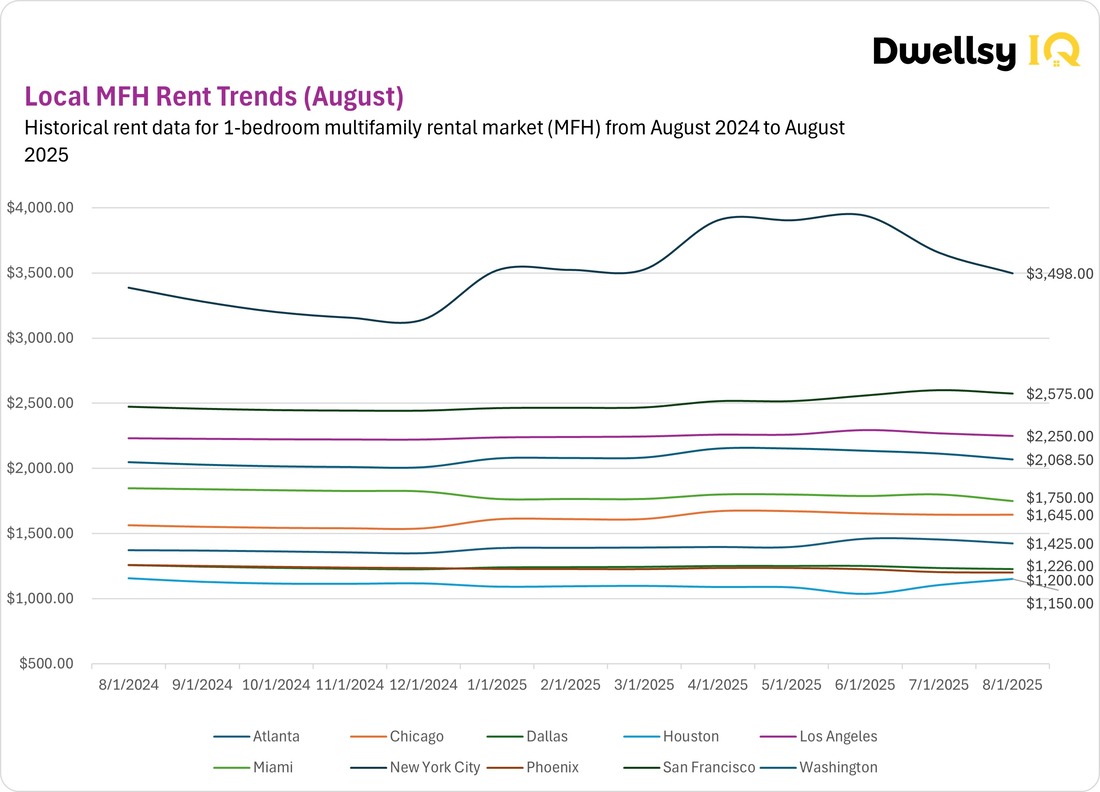

The August 2025 multifamily housing (MFH) market for 1-bedroom rentals highlights the fragmented state of U.S. rental trends. The latest multifamily data shows that some metros, such as Chicago, posted strong year-over-year (YoY) gains, while others, like Miami, recorded declines. Month-over-month (MoM) shifts reveal late-summer corrections following the peak rental season.

Methodology

This report analyzes trends in the U.S. single-family rental (SFR) market, focusing on three-bedroom homes across 10 major metro areas. This report analyzes three-bedroom single-family rentals (SFRs) across 10 major U.S. metros, based on over 16 million verified listings. Data is cleaned to remove duplicates, errors, and outliers, then tracked month-over-month and year-over-year to show both seasonal and long-term trends. Figures are released as preliminary and may shift slightly, as final numbers are confirmed about two months later to ensure accuracy. See full methodology here.

Main Takeaways

– Strong Growth Markets: Chicago (+5.2% YoY), San Francisco (+4.1% YoY), Atlanta (+3.8% YoY), New York (+3.3% YoY), Washington (+1.0% YoY).

– Softening Markets: Miami (-5.3% YoY), Phoenix (-4.5% YoY), Dallas (-2.5% YoY), Houston (-0.5% YoY).

– Stable Markets: Los Angeles (+0.8% YoY).

High-Cost Metros: New York, San Francisco, Los Angeles

High-cost metros continue to set the tone for the multifamily rental market. San Francisco rents ended August at $2,575, down -1.0% MoM but still 4.1% higher YoY, showing resilience despite recent dips. Los Angeles fell slightly to $2,250, down -0.9% MoM but holding +0.8% YoY, suggesting stability at a high plateau. New York City dropped to $3,498, a sharp -4.3% MoM decrease, yet rents remained 3.3% higher YoY, underscoring its longer-term strength.

Mid-Tier Market: Washington, Miami, Chicago

Washington closed August at $2,068.5, down -2.1% MoM but still +1.0% YoY, suggesting steady annual growth despite monthly volatility. Chicago stood out with $1,645, flat MoM but up 5.2% YoY, the strongest annual increase across all metros. Miami softened further to $1,750, down -2.8% MoM and -5.3% YoY.

Affordable Metros: Atlanta, Dallas, Houston, Phoenix

Atlanta decreased to $1,425, falling -2.1% MoM but still 3.8% higher YoY, marking it as one of the more resilient affordable markets. Dallas slipped to $1,226, down -0.6% MoM and -2.5% YoY, confirming its place among the weaker performers in the MFH data. Houston rose to $1,150, up 4.2% MoM but -0.5% YoY, signalling recovery in the short term but still below last year’s levels. Phoenix ended at $1,200, nearly flat MoM (-0.3%) but -4.5% YoY, underscoring ongoing cooling.

Conclusion

The July 2025 multifamily rent data underscores the uneven nature of the 1-bedroom rental market across the U.S. Atlanta, New York City, San Francisco, and Chicago recorded strong annual growth, while Houston, Phoenix, Dallas, and Miami weakened, with Houston posting the steepest decline. Los Angeles and Washington remained comparatively stable, balancing modest growth against short-term fluctuations.

FAQ

What does the August 2025 multifamily rental data show about the U.S. market?

The August 2025 multifamily rental data highlights a fragmented market across major metros. High-cost hubs like New York and San Francisco continued to show resilience, while Chicago and Atlanta posted the strongest gains among mid-tier and affordable markets. In contrast, the latest MFH data shows that Miami, Phoenix, Dallas, and Houston softened.

Which cities saw the highest rent increases in August 2025?

According to the August 2025 MFH data, the strongest year-over-year rent growth came from Chicago (+5.2% YoY), San Francisco (+4.1% YoY), Atlanta (+3.8% YoY), and New York (+3.3% YoY). Washington also posted steady gains (+1.0% YoY), reinforcing its role as a stable metro in the multifamily housing market.

Which cities experienced rent declines in August 2025?

The multifamily data shows the sharpest YoY declines in Miami (–5.3% YoY), Phoenix (–4.5% YoY), Dallas (–2.5% YoY), and Houston (–0.5% YoY).