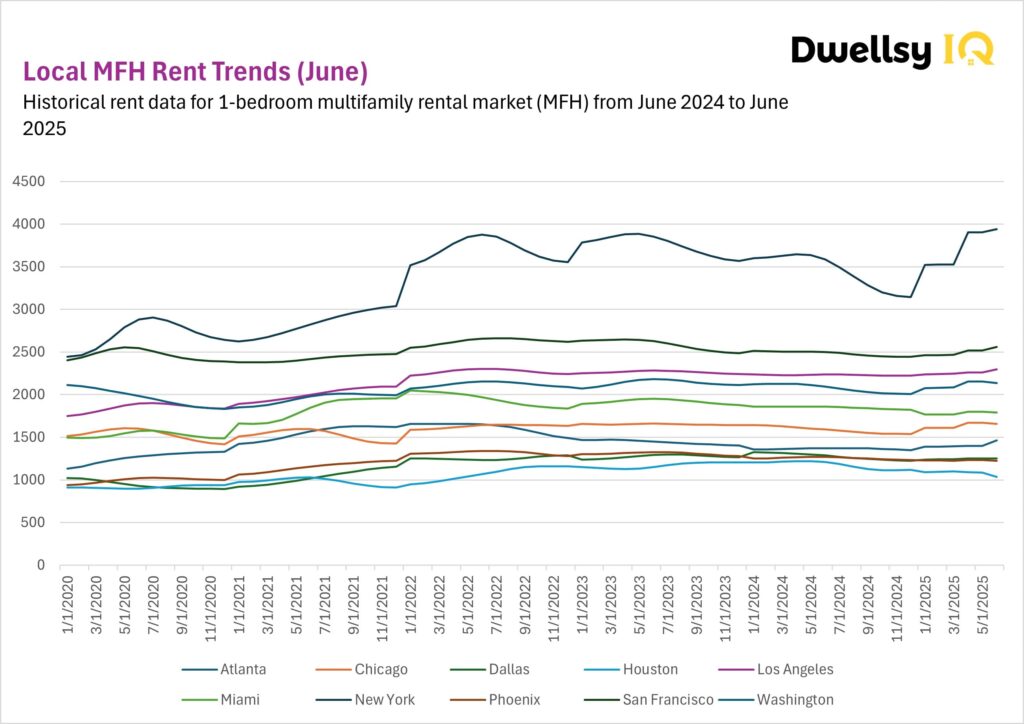

In this analysis, we examine rent trends for 1-bedroom MFHs across 10 major metros in the U.S. rental market. Based on verified data from millions of active listings on the Dwellsy Marketplace between June 2024 and June 2025.

Methodology

This report analyzes trends in the U.S. single-family rental (SFR) market, focusing on three-bedroom homes across 10 major metro areas. This report analyzes three-bedroom single-family rentals (SFRs) across 10 major U.S. metros, based on over 16 million verified listings. Data is cleaned to remove duplicates, errors, and outliers, then tracked month-over-month and year-over-year to show both seasonal and long-term trends. Figures are released as preliminary and may shift slightly, as final numbers are confirmed about two months later to ensure accuracy. See full methodology here.

The multifamily housing market for 1-bedroom rentals shows sharp contrasts across US metros. From surging coastal hubs to softening Sunbelt cities, rents in June 2025 reflect broader shifts in affordability, demand, and supply constraints. This report categorizes 10 major metros into High-Cost, Mid-Tier, and Affordable markets to give a clear picture of performance and outlook.

Main Takeaways

- Strong Growth Markets: New York (+10.0% YoY), Atlanta (+6.6% YoY), and Chicago (+4.1% YoY) continued to climb, likely supported by strong demand and population growth.

- Softening Markets: Houston (-14.3% YoY), Miami (-3.7% YoY), Phoenix (-3.4% YoY), and Dallas (-2.8% YoY) declined, which might reflect affordability pressures and cooling demand.

- Stable Markets: San Francisco (+2.4% YoY), Los Angeles (+2.7% YoY), and Washington (+2.0% YoY) remained steady, posting modest but consistent gains.

High-Cost Metros: New York, San Francisco, Los Angeles, Washington

New York leads the nation, with June 2025 rents climbing to $3,941, a 10% YoY gain and the steepest increase across all metros. San Francisco remains elevated at $2,560, but growth slowed to just +2.4% YoY. Los Angeles continues its steady rise, up 2.7% YoY to $2,295, while Washington offers the most stability of this group at $2,135 (+2% YoY), showing only minor fluctuations over the past year.

Mid-Tier Market: Miami, Chicago, Atlanta

Miami slipped to $1,788 (-3.7% YoY). After rapid rent growth through 2022, the market is now cooling, likely due to affordability pressures and reduced inflows compared to its pandemic peak. Chicago rose to $1,655 (+4.1% YoY), demonstrating steady appreciation and stable demand. Atlanta outperformed with a jump to $1,461 (+6.6% YoY), which might be fueled by strong job growth and in-migration, positioning it as the fastest-growing non-coastal metro.

Affordable Metros: Dallas, Houston, Phoenix

Dallas held steady at $1,250 (flat YoY), while Houston fell sharply to $1,037 (-4.5% YoY), the steepest decline of all metros. Phoenix, once a fast riser, also slipped to $1,225 (-3.4% YoY).

Conclusion

The 1-bedroom MFH rental market in June 2025 highlights diverging dynamics: coastal hubs like New York continue to surge, mid-tier cities like Chicago and Atlanta show steady growth, while Sunbelt affordability markets are cooling.

FAQ

What does the June 2025 multifamily data show about the U.S. rental market?

The June 2025 multifamily data reveals that high-cost metros like New York continued to surge, while Sunbelt affordability markets such as Houston, Dallas, and Phoenix softened. Mid-tier cities like Chicago and Atlanta showed steady growth, and coastal hubs like San Francisco, Los Angeles, and Washington remained stable.

Which cities saw the highest rent increases in June 2025?

The strongest YoY growth came from New York (+10.0% YoY), Atlanta (+6.6% YoY), and Chicago (+4.1% YoY), which might be caused by high demand, job growth, and limited supply.

Which cities experienced rent declines in June 2025?

The sharpest decline was in Houston (-14.3% YoY), followed by Miami (-3.7% YoY), Phoenix (-3.4% YoY), and Dallas (-2.8% YoY), which might reflect affordability challenges and demand corrections.

Where can I buy multifamily housing data or rental data?

Reliable rental datasets can be purchased from specialized providers that aggregate verified listings and market information. Dwellsy offers access to multifamily (MFH) and single-family rental (SFR) data, serving proptech firms, universities, data companies, geospatial businesses, and hedge funds. These datasets include historical trends, comparable properties, rent benchmarks, and granular insights to support accurate decision-making.