The U.S. rental market has split into two very different stories. Single-family rentals have experienced volatility since 2020, with a pandemic-driven surge, a cooling period, and a gradual correction. Multifamily rentals, by contrast, have taken a different path: stable through the pandemic and now slipping slightly below 2020 levels. This report analyzes national trends for both single-family and multifamily rentals from January 2020 through June 2025, using data from more than 16 million rentals listed on the Dwellsy Marketplace.

Methodology

This report analyzes national rental trends in both the single-family rental (SFR) and multifamily housing (MFH) markets, focusing on three-bedroom homes for SFR and one-bedroom apartments for MFH. Drawing from the more than 16 million rentals that list on the Dwellsy.com Marketplace, the dataset represents real-time market behavior rather than projections or survey estimates. These insights are based entirely on observed listings, ensuring that the results reflect actual market activity as it occurs. For details on data preparation, quality controls, and analytical techniques, see the full methodology.

Disclaimer: At Dwellsy, we place the highest priority on the accuracy and reliability of our data. While Gaussian filtering to remove outliers has long been part of the values we provide to clients, since July we’ve extended this methodology to the data we release publicly as well. This ensures that unusual data points do not distort the true market picture and reflects our ongoing commitment to delivering clear, dependable insights into the rental market.

National Trends: SFR vs. MFH (2020–2025)

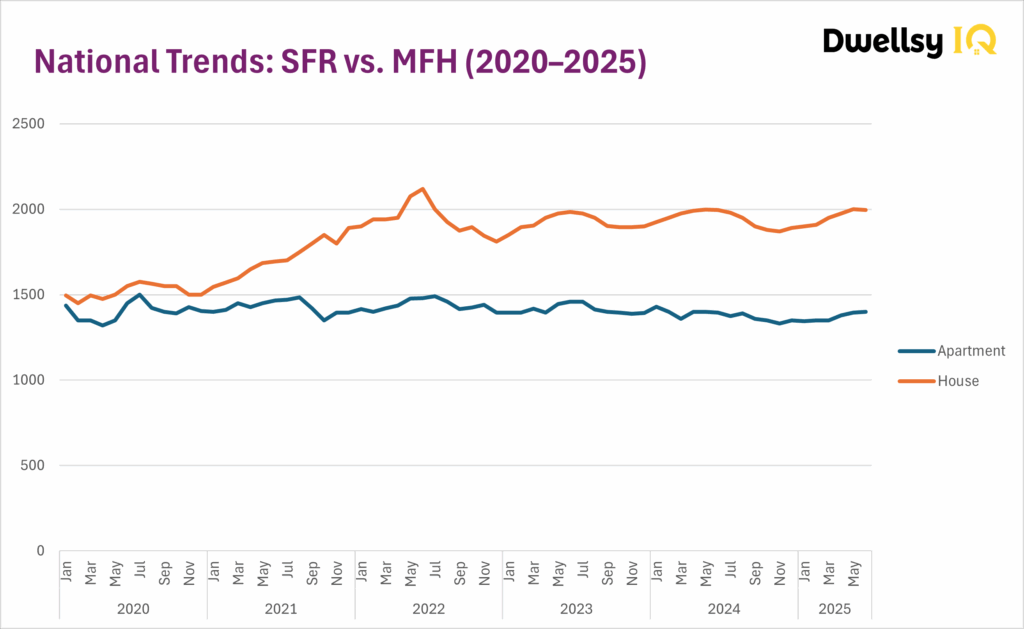

In early 2020, the rental market revealed a surprising imbalance: three-bedroom single-family rentals (SFR) and one-bedroom apartments in multifamily housing (MFH) were renting for almost the same price, both averaging around $1,450. These are fundamentally different homes designed for different household sizes. That near-parity was an interesting characteristic of a marketplace that was placing a similar value on two very different types of home. One a small apartment, most frequently found in denser areas (often 800-1,000 sqft) and the other a larger house (often 2,000+ sqft) with a yard and a garage. Was this a sign that the market was out of balance or just a value judgement based on how Americans chose to live at the time?

Either way, in the five years that followed, the two dramatically diverged and our analysis and data show how differently these two segments have adjusted to changing market conditions.

2020 to mid?2022: SFR Pandemic-driven surge vs. MFH stability

As the pandemic reshaped where and how people wanted to live, demand for larger homes surged. By mid?2022, the average rent for a single-family home had climbed to $2,120—a 42% increase—while apartment rents barely moved, holding close to $1,400. This sharp divergence was an after?effect of the pandemic: many would argue it was a demand shock that pushed SFR rents far above prior levels. MFH, by contrast, remained steady through this period, showing only minor year-over-year increases.

Late 2022: Cooling for SFR, steadiness for MFH

When the pandemic surge subsided, the SFR market began to cool quickly. By December 2022, rents for single-family homes had fallen back to $1,810 as demand eased and the unprecedented spike unwound–somewhat. Multifamily rents showed little volatility during the same period, staying near $1,400.

2023: Recalibration and the beginning of correction

With the crisis-driven pressures behind it, 2023 became a year of recalibration. SFR rents flattened and even slipped slightly, posting a –2.6% year-over-year change. MFH rents, while still more stable, also softened slightly during this time, signaling that demand was easing across the rental market. This was the period when prices in both segments began to align more closely with underlying demand rather than pandemic shocks.

2024 to mid 2025: Selective growth in SFR, stagnation in MFH

By 2024, single-family rentals began to grow again, but at a much steadier pace. SFR rents rose 4.1% on the year, peaking at $1,999 in May. Early 2025 has continued along that slower, more stable path, with rents rising from $1,950 in March to $1,995 by June. On a June-to-June basis, SFR rents are now essentially flat (+0.1%), showing that the earlier surge has been fully absorbed. Over the full five-year period, SFR rents posted a compound annual growth rate (CAGR) of 5.56%, reflecting how the segment has adjusted from volatility into long-term growth.

Multifamily rents, in contrast, have drifted downward. After modest gains in 2021–2022, they slipped back into the $1,380–$1,400 range, falling from $1,468 in June 2024 to $1,389 in June 2025—a 5.38% decline. Over the same five-year period, multifamily rents show a CAGR of –0.60%, underscoring a market that has been stable but stagnant.

The resulting gap

The outcome of these very different trajectories is a wide and stable rent gap. In 2020, the difference between the two segments was just $60 to $100. By 2025, it has consistently exceeded $500 and at times reached more than $660. What began as a short-lived, pandemic-driven spike has, over the past two years, turned into a lasting structural separation: single-family rentals now command a much higher price, while apartment rents remain anchored.

Conclusion

The last five years tell a clear two-part story. First came a sharp pandemic-era surge, which pushed single-family rents to new highs, followed by a cooling period as that surge unwound. From 2023 onward, the market began to correct and establish the structure we see today: 3-bedroom single-family rentals, which in early 2020 were priced close to 1-bedroom apartments, now carry a consistent premium. Multifamily rents have been largely flat throughout, leaving a stable but wide gap between the two segments. That gap—hundreds of dollars each month—shows no sign of closing, and single-family rentals have emerged as the premium-priced option in this rebalanced market.