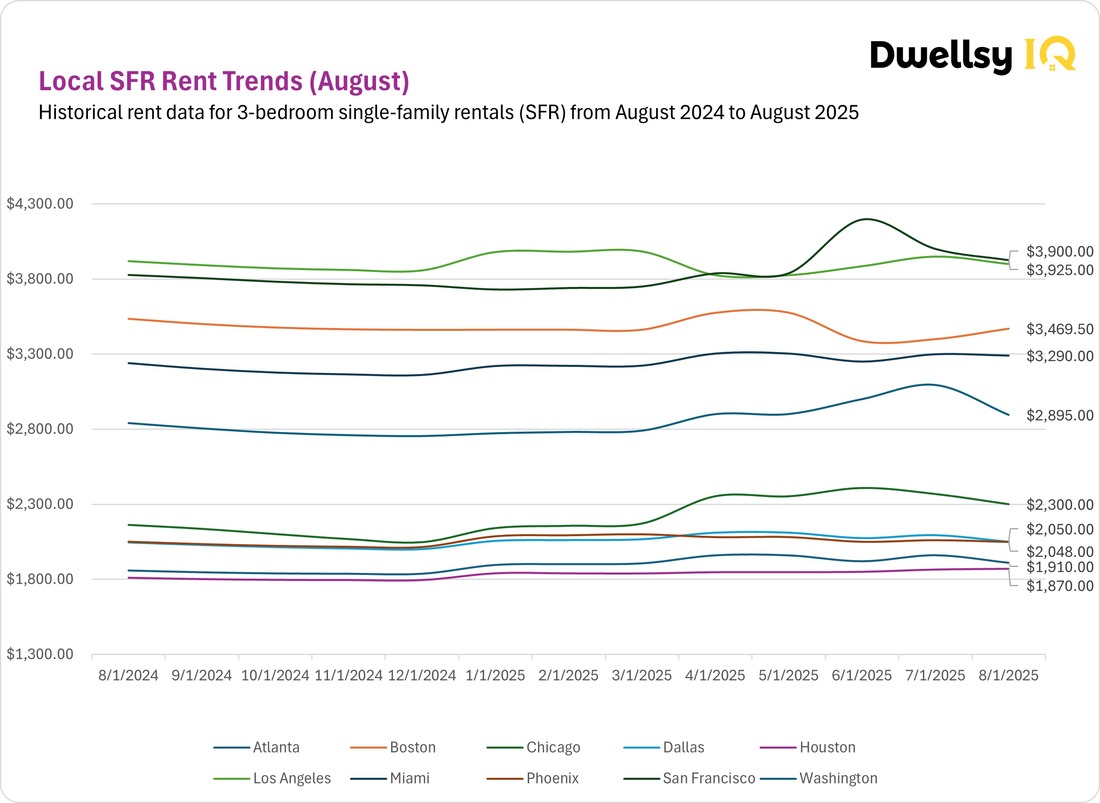

The August 2025 data for 3-bedroom single-family rentals (SFRs) shows a fragmented rental landscape across major U.S. metros. Some markets posted strong year-over-year (YoY) growth, while others softened or corrected after earlier gains.

Methodology

This report analyzes trends in the U.S. single-family rental (SFR) market, focusing on three-bedroom homes across 10 major metro areas. This report analyzes three-bedroom single-family rentals (SFRs) across 10 major U.S. metros, based on over 16 million verified listings. Data is cleaned to remove duplicates, errors, and outliers, then tracked month-over-month and year-over-year to show both seasonal and long-term trends. Figures are released as preliminary and may shift slightly, as final numbers are confirmed about two months later to ensure accuracy. See full methodology here.

Main takeaways

– Strong Growth Markets: Chicago (+6.3% YoY), Houston (+3.3% YoY), San Francisco (+2.6% YoY), Atlanta (+2.8% YoY).

– Softening Markets: Boston (–1.8% YoY), Los Angeles (–0.5% YoY), Phoenix (–0.1% YoY).

– Stable Markets: Dallas (+0.2% YoY), Miami (+1.6% YoY), Washington (+1.9% YoY).

High-Cost Metros: San Francisco, Los Angeles, Boston

San Francisco rents reached $3,925, down –1.8% MoM from July but still 2.6% above last year, showing resilience despite a mid-summer correction. Los Angeles climbed slightly to $3,900, up 1.2% MoM but 0.5% below July. Boston edged up to $3,469, gaining 2% MoM, though still –1.8% YoY, reflecting a subtle weakness.

Mid-High Tier: Washington, D.C. and Miami

Washington closed August at $2,895, down 6.5% MoM but still 1.9% higher YoY, suggesting steadier long-term growth despite a sharp monthly dip. Miami reached $3,290, a 0.3% MoM decrease yet a 1.6% YoY gain.

Mid-Tier Metros: Chicago, Dallas, Phoenix

Chicago stood out with the strongest YoY performance at +6.3%, though rents slipped –2.9% MoM to $2,300. Dallas decreased modestly to $2,050, down 2.2% MoM yet with a positive 0.2% YoY. Phoenix ended at $2,048, down 0.6% MoM but flat YoY (–0.1%).

Affordable Metros: Atlanta and Houston

Atlanta decreased to $1,910, down 2.6% MoM and 2.8% YoY, reflecting a decline. Houston rose to $1,870, up 0.2% MoM and 3.3% YoY, placing it among the better-performing affordable markets.

Conclusion

The August 2025 SFR rental data underscores the uneven dynamics across major U.S. metros. Chicago, Houston, and San Francisco posted solid year-over-year gains, highlighting continued demand in those markets. Boston, Los Angeles, Phoenix, and Atlanta softened. Dallas, Miami, and Washington remained comparatively stable, showing limited but steady movement.

FAQ

What does the August 2025 SFR rental data show about the U.S. market?

The August 2025 single-family rental (SFR) data shows a fragmented market. Some metros like Chicago, Houston, and San Francisco continued to grow, while others such as Boston, Los Angeles, Phoenix, and Atlanta softened. Dallas, Miami, and Washington remained relatively stable with modest year-over-year changes.

Which cities saw the highest rent increases in August 2025?

According to the August 2025 SFR rental data, the strongest year-over-year gains were in Chicago (+6.3% YoY), Houston (+3.3% YoY), Atlanta (+2.8% YoY), and San Francisco (+2.6% YoY).

Which cities experienced rent declines in August 2025?

The metros with the sharpest year-over-year declines were Atlanta (–2.8% YoY), Boston (–1.8% YoY), Los Angeles (–0.5% YoY), and Phoenix (–0.1% YoY).

How can SFR rental data help understand market trends?

SFR rental data provides insight into how rents are shifting across metros, highlighting areas of strong growth, stability, or decline. Tracking both month-over-month and year-over-year changes helps reveal seasonal effects, affordability pressures, and long-term demand patterns in the housing market.

Where can I buy single-family rental data?

Reliable SFR rental data can be purchased from specialized providers that aggregate verified listings and rental market information. Companies like Dwellsy offer access to single-family rental data for investors, proptech firms, universities, data companies, geospatial businesses, and hedge funds. These datasets often include historical trends, comparable properties, rent benchmarks, and a range of other data points to support informed decision-making.