In this analysis, we examine rent trends for 3-bedroom SFRs across 10 major metros in the U.S. rental market. Based on verified data from millions of active listings on the Dwellsy Marketplace between May 2024 and May 2025.

Methodology

This report analyzes trends in the U.S. single-family rental (SFR) market, focusing on three-bedroom homes across 10 major metro areas. Based on over 16 million verified listings, all data was vetted for accuracy and filtered using a Gaussian method to reduce outliers. We tracked month-over-month and year-over-year changes to reveal both seasonal and long-term shifts. Insights are based on observed listing data, not surveys or projections, offering a real-time view of SFR market behavior. Chart axes were scaled by subtracting ~500 from the minimum value and adding ~500 to the maximum. See full methodology here.

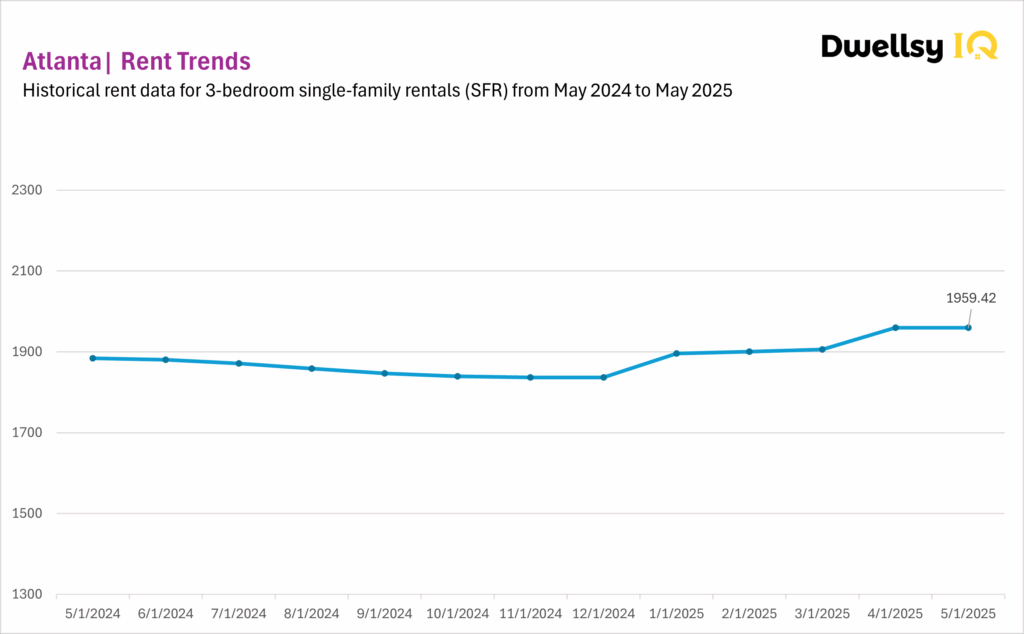

Atlanta

In April, Atlanta’s single-family rental market saw a 2.8% increase, followed by a complete plateau in May, with a -0.01% month-over-month change. This flat reading might reflect a pause after April’s price adjustment.

Compared to last year, rents in May were up 4.0%, indicating a gradual recovery from earlier declines. Taken together, the monthly data and the yearly data support the broader narrative of cautious but sustained momentum. Atlanta’s market might be transitioning into a more stable growth phase, though the stall in May suggests it’s not yet on solid footing.

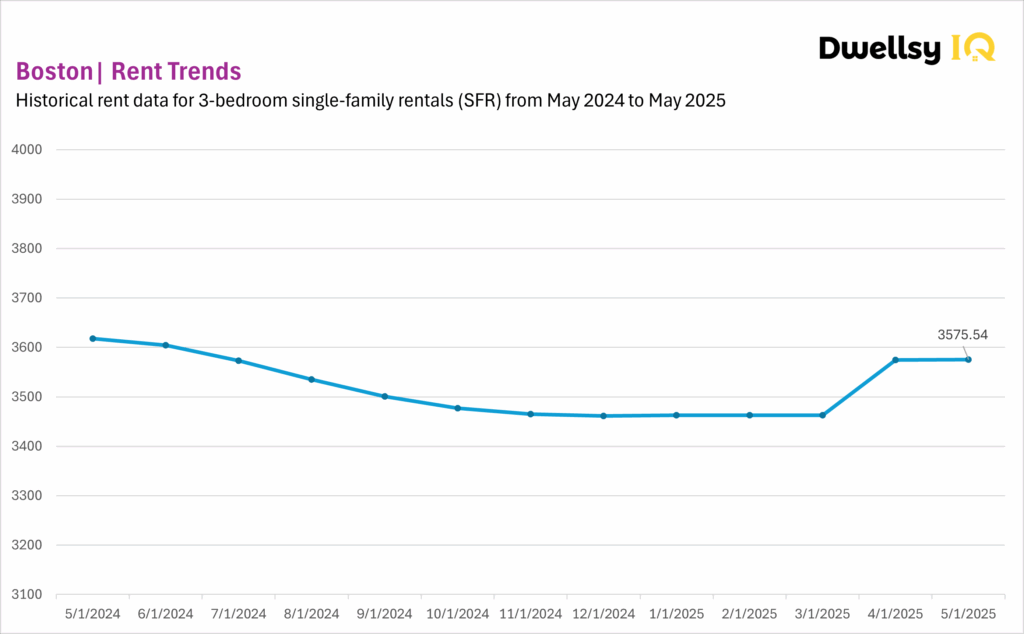

Boston

After a strong 2.5% rebound in April 2025, Boston’s single-family rental market essentially flatlined in May, with rents ticking up just 0.03%. This lack of follow-through might reflect affordability ceilings or saturation after April’s delayed leasing activity surged all at once. While the April spike hinted at a reset, May’s stall suggests that momentum remains inconsistent.

Compared to last year, rents were down 1.2%, suggesting that prices haven’t fully recovered from the 2024 correction. While April hinted at a turnaround, May’s performance indicates the market might be struggling to sustain gains and could still be searching for its post-peak equilibrium.

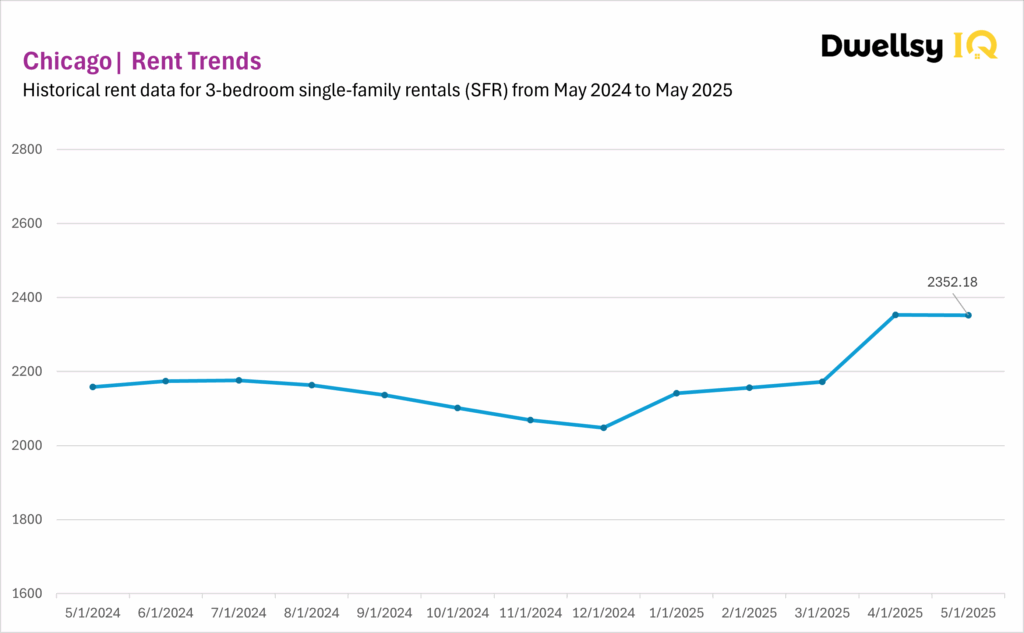

Chicago

Chicago’s single-family rental market paused in May after April’s record-setting 8.34% jump, with rents dipping just -0.03%. This minor pullback might reflect a temporary ceiling after strong spring demand accelerated pricing. While the market didn’t build on April’s momentum, it also didn’t reverse significantly, suggesting a potential breather rather than a shift.

Year-over-year (May 2024-May 2025), May rents were up 9.0%, one of the strongest YoY gains in the dataset, reinforcing the broader trend of steady growth and supporting the idea that Chicago might be entering a second wave of expansion.

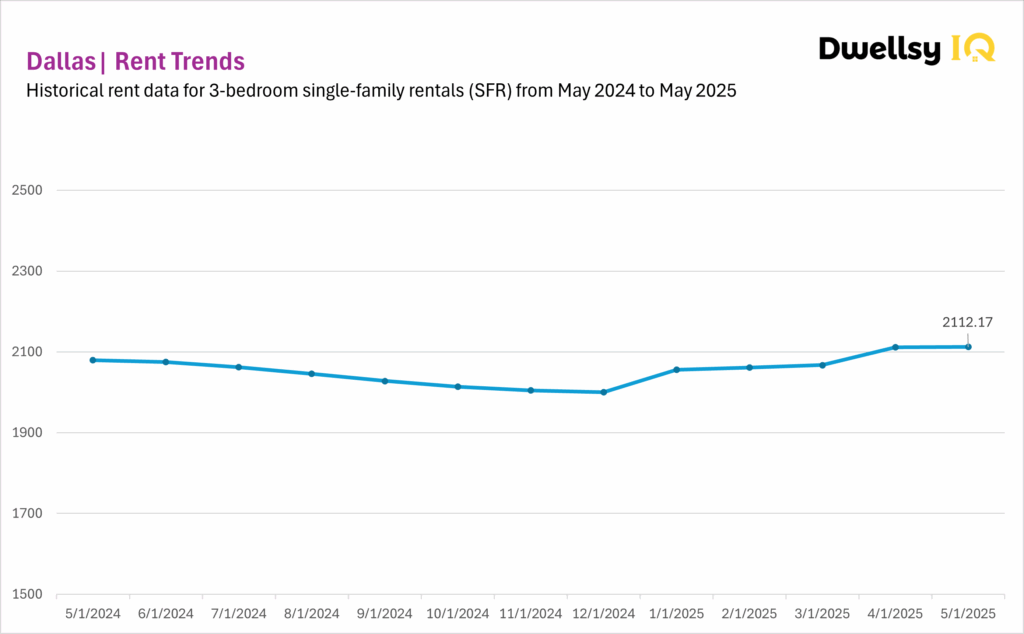

Dallas

Dallas’s single-family rental market remained stable in May, following a +2.16% gain in April. The minimal +0.02% change suggests the market might be pausing after its spring lift, potentially reflecting price sensitivity or a natural recalibration. This steady behavior is in line with Dallas’s broader pattern of gentle cycles of modest gains followed by soft corrections.

Year-over-year (May 2024-May 2025), rents were up 1.6%, reinforcing the view of a slow recovery from the 2024’s correction. Rather than signaling a shift in direction, May’s performance fits the metro’s reputation for gradual, orderly adjustments, suggesting that Dallas might be settling into a new pricing range with mild upward pressure.

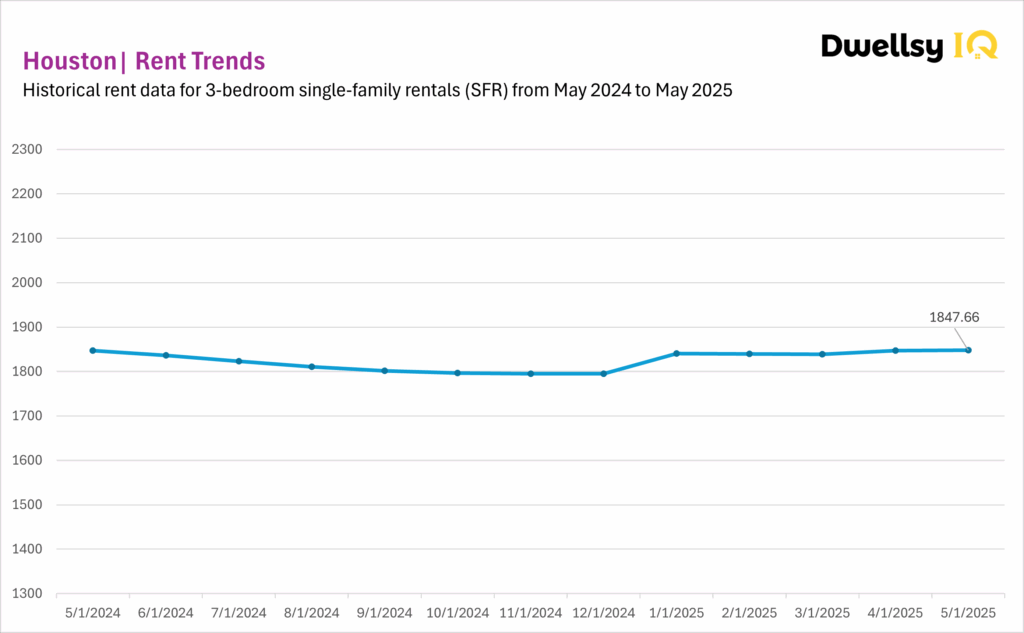

Houston

Houston’s single-family rental market showed no real movement in May, with a minimal +0.02% monthly increase. This follows a modest gain in April and suggests the market might be hitting resistance or settling into a seasonal plateau.

Year-over-year (May 2024-May 2025), rents were unchanged, reinforcing the picture of a market stuck in a holding pattern. The brief early-2025 increases might be exceptions rather than signs of sustained momentum. Without a stronger seasonal push, Houston’s rent levels might continue to hover near this flatline.

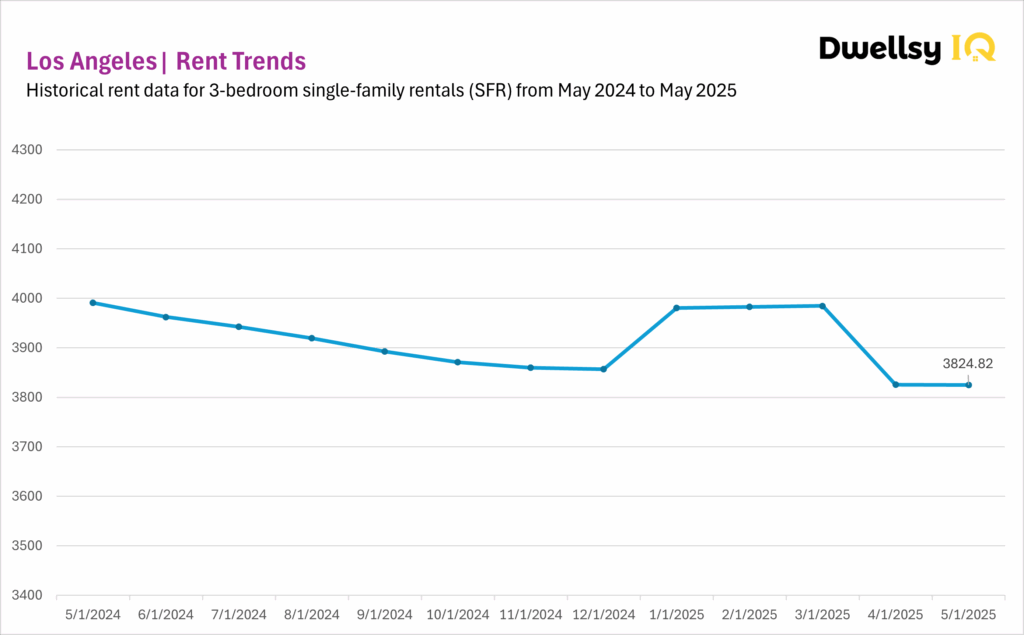

Los Angeles

Los Angeles’ single-family rental market showed no movement in May 2025, with rents effectively flat after April’s sharp -4.0% drop. The -0.01% MoM shift suggests the market might be pausing after a significant adjustment, with no clear signal of renewed growth or further decline.

On a year-over-year basis (May 2024-May 2025), rents are down 4.2%, consistent with the steep drop seen since mid-2023. The market might be searching for a stable floor, but recent volatility suggests that even modest gains might struggle to hold.

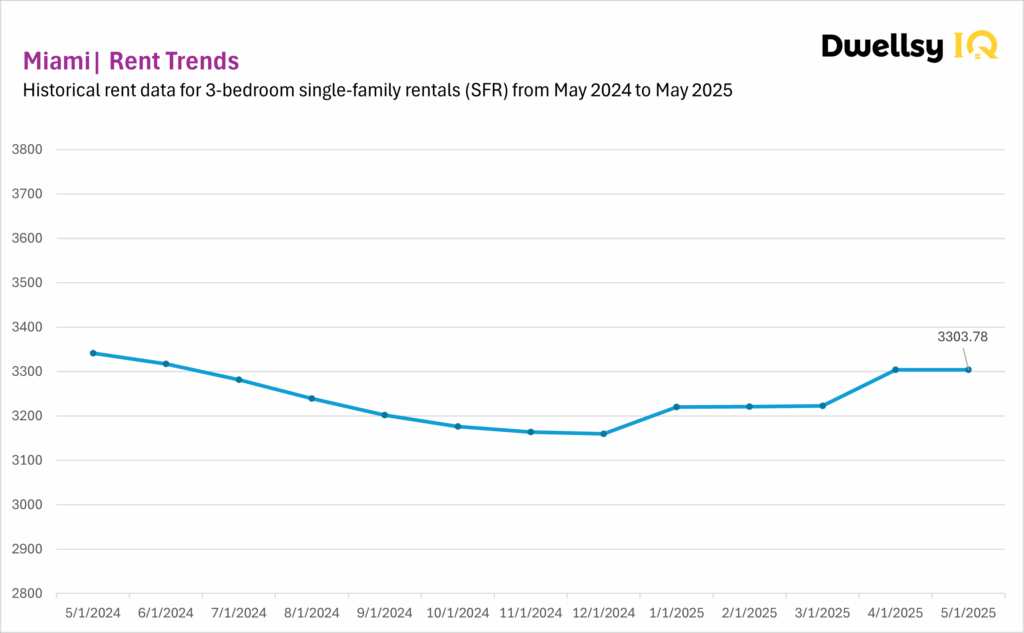

Miami

Miami’s single-family rental market stalled in May 2025, with an unchanged MoM following April’s +2.52% gain. The lack of momentum suggests pricing might have reached a temporary ceiling.

Year-over-year (May 2024-May 2025), rents are still down 1.1%, showing that recovery from the 2024 correction is incomplete. While April hinted at renewed demand, May’s flat result points to continued hesitation. Future pricing trends will likely depend on how summer demand unfolds.

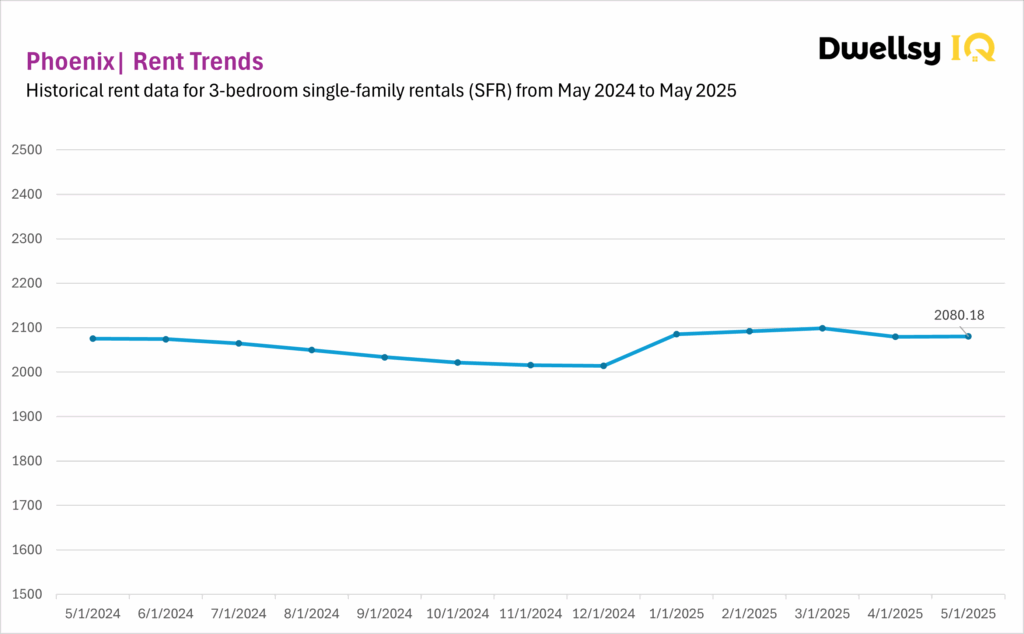

Phoenix

Phoenix’s single-family rental market had a minimal +0.02% increase in May 2025 following several months of modest gains. This flat result aligns with the broader pattern observed through 2024 and early 2025 – an extended correction followed by signs of slow stabilization. After a strong +3.5% spike in January and incremental gains through April, May’s result might reflect a seasonal pause or suggest that prices are approaching a temporary ceiling.

Year-over-year (May 2024-May 2025), rents are up just 0.2%, consistent with the five-year narrative of cautious recovery. While Phoenix might be emerging from its correction phase, the market remains fragile, and momentum has yet to build. The next few months will be key in determining whether stability can evolve into sustainable growth.

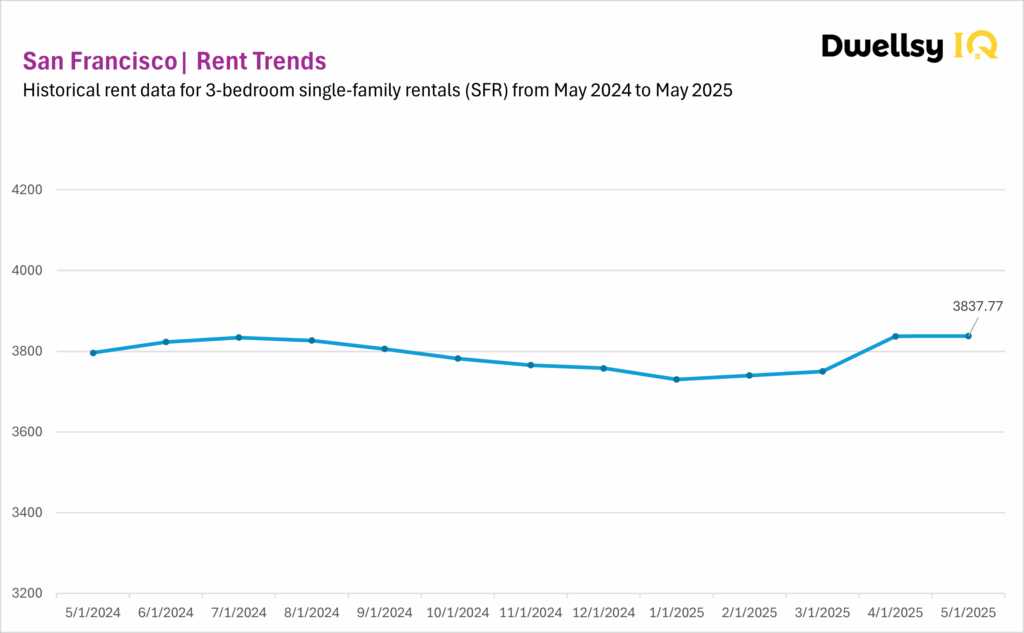

San Francisco

San Francisco’s single-family rental market recorded a 0.01% gain in May, following a +2.6% surge in April. This minimal growth suggests the market might be entering a plateau phase after the spring surge – or it might simply be pausing before further movement. The flat reading could reflect seasonal rhythms, short-term resistance, or a temporary reset.

Year-over-year (May 2024-May 2025), rents rose by 1.1%, consistent with the metro’s longer-term pattern of modest but steady growth. While volatility remains low and seasonality remains a key driver, May’s result leaves open the question of whether the spring rebound has run its course or if further gains are still ahead.

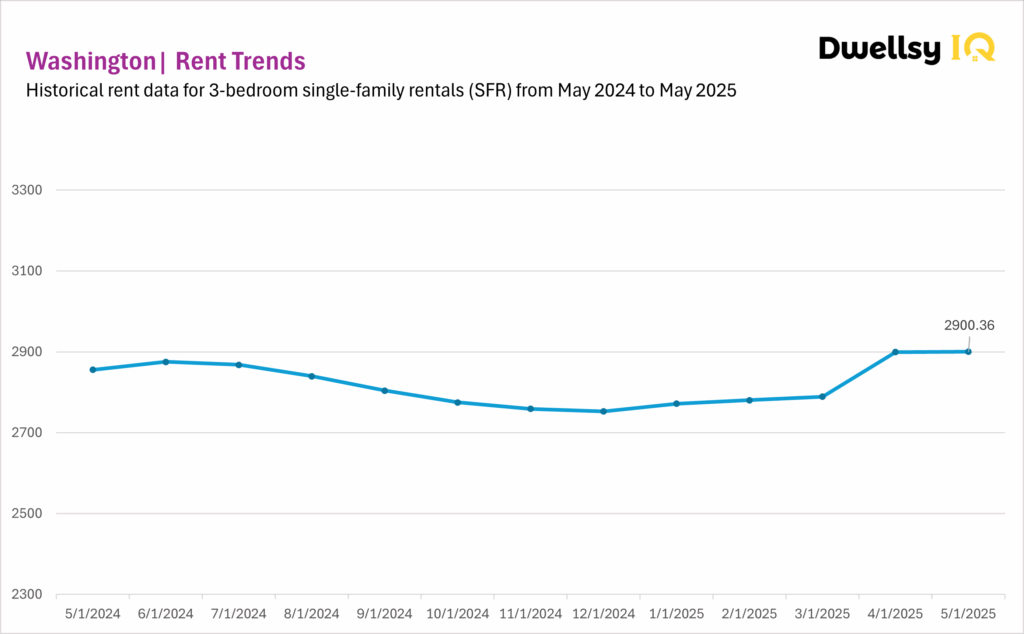

Washington

Washington’s single-family rental market stalled in May, rising 0.02% after April’s strong +4.0% increase. This pause is in line with the metro’s established seasonal rhythm – strong spring gains followed by mid-year leveling. May’s stall might reflect normal seasonal cooling or resistance after April’s rent resets.

Year-over-year growth (May 2024-May 2025) reached +1.6%, a stable gain that fits the metro’s long-term pattern of consistent appreciation. While the May plateau hints at temporary softness, Washington remains one of the most resilient and predictable rental markets, with low volatility and a steady upward trajectory.